Lattice Semiconductor sits in a unique corner of the semiconductor market: low-power FPGAs used in everything from industrial control to datacenter infrastructure. As the broader chip sector moves through uneven cycles, Lattice has focused on consistent execution, tight cost control, and product bets aligned with emerging workloads like AI inference and robotics. This continues under new CEO Ford Tamer, who has been in the role since September 2024.

The FPGA market is structurally long-tail designs often stay in production for a decade or more, and older product lines continue to generate meaningful revenue years after launch. Lattice has historically benefited from this durability. But the company is now layering in a refreshed portfolio: Nexus 2 for bandwidth-intensive edge use cases and Avant for mid-range compute. These newer platforms are beginning to renew the franchise.

In Q1 2025, the company reported revenue of $120.1 million, up from $117.4 million in the prior quarter – its first sequential increase in over a year. Gross margin recovered to 69%, rebounding from a brief dip to 62% in Q4 and returning to the high levels Lattice has historically maintained. While macro uncertainty still hangs over the sector, this quarter offered signs that Lattice’s strategic positioning is starting to pay off..

The rebound was anticipated. CEO Ford Tamer described the quarter as having “developed as expected,” pointing to record design win activity and further expansion in operating margins. He also highlighted the breadth of new demand drivers, from generative AI acceleration in the datacenter to robotics, AR/VR, and post-quantum cryptography. These are not just aspirational buzzwords. Many of these workloads depend on real-time inference at the edge or in constrained thermal envelopes, an area where Lattice’s low-power FPGAs have historically thrived. The new Avant platform, designed for mid-range applications, and Nexus 2, aimed at expanding the core low-power roadmap, are both intended to push that advantage further.

Still, visibility remains a challenge. Tamer tempered the upbeat tone by noting the company is “monitoring the market environment,” given broader uncertainty in semis. While the worst may be over for Lattice and new designs are clearly ramping, the trajectory back to former revenue highs is not guaranteed, especially with inventory still elevated.

Key Takeaways (GAAP)

💵 Q1 Revenue: $120.1 million, down 15% YoY and up 2.3% QoQ

📈 Q1 Gross Margin: 68.0%, down 30 bps YoY and up 690 bps QoQ

💰 Q1 Net Income: $5.0 million, down 66% YoY and down 70% QoQ

🏛️ Q1 EPS: $0.04, down 64% YoY from $0.11 and down 67% QoQ from $0.12

Key Takeaways (Non-GAAP)

💵 Q1 Revenue: $120.1 million, same as GAAP

📈 Q1 Gross Margin: 69.2%, down 10 bps YoY and up 720 bps QoQ

💰 Q1 Net Income: $31.4 million, down 37% YoY and up 11% QoQ

🏛️ Q1 EPS: $0.23, down 36% YoY and up 10% QoQ

Revenue has stabilized, but we’re still far from the peak.

Q1’s $120.1 million in revenue is a 2.3% sequential increase, but still down 37% from the $192 million high reached in Q3 2023. This marks the first positive sequential movement in over a year, but it is not yet a trend. While Lattice attributes the growth to new application demand, the recovery curve is flatter than what peers with broader portfolios have posted this cycle.

Gross margin is back to normal, for now.

Non-GAAP gross margin returned to 69%, recovering quickly from the Q4 drop to 62%. That drop appears to have been a one-off rather than the start of a structural reset. Lattice has historically maintained 69 to 71% margins for nearly two years straight. The reversion implies pricing and product mix, likely with Avant and Nexus 2 contributing, remains favorable even at lower volumes.

Inventory remains historically high.

Inventory days ended the quarter at 225, up from Q4’s 207 and well above the company’s pre-2022 norm. Accounts receivable stayed flat at 64 days. The inventory-to-revenue ratio remains elevated at 3.29, suggesting Lattice is still burning through excess stock built up during the 2022 to 2023 cycle. This overhang will likely weigh on gross margins and revenue growth velocity in the near term.

Communications and compute lead. Industrial and automotive held steady.

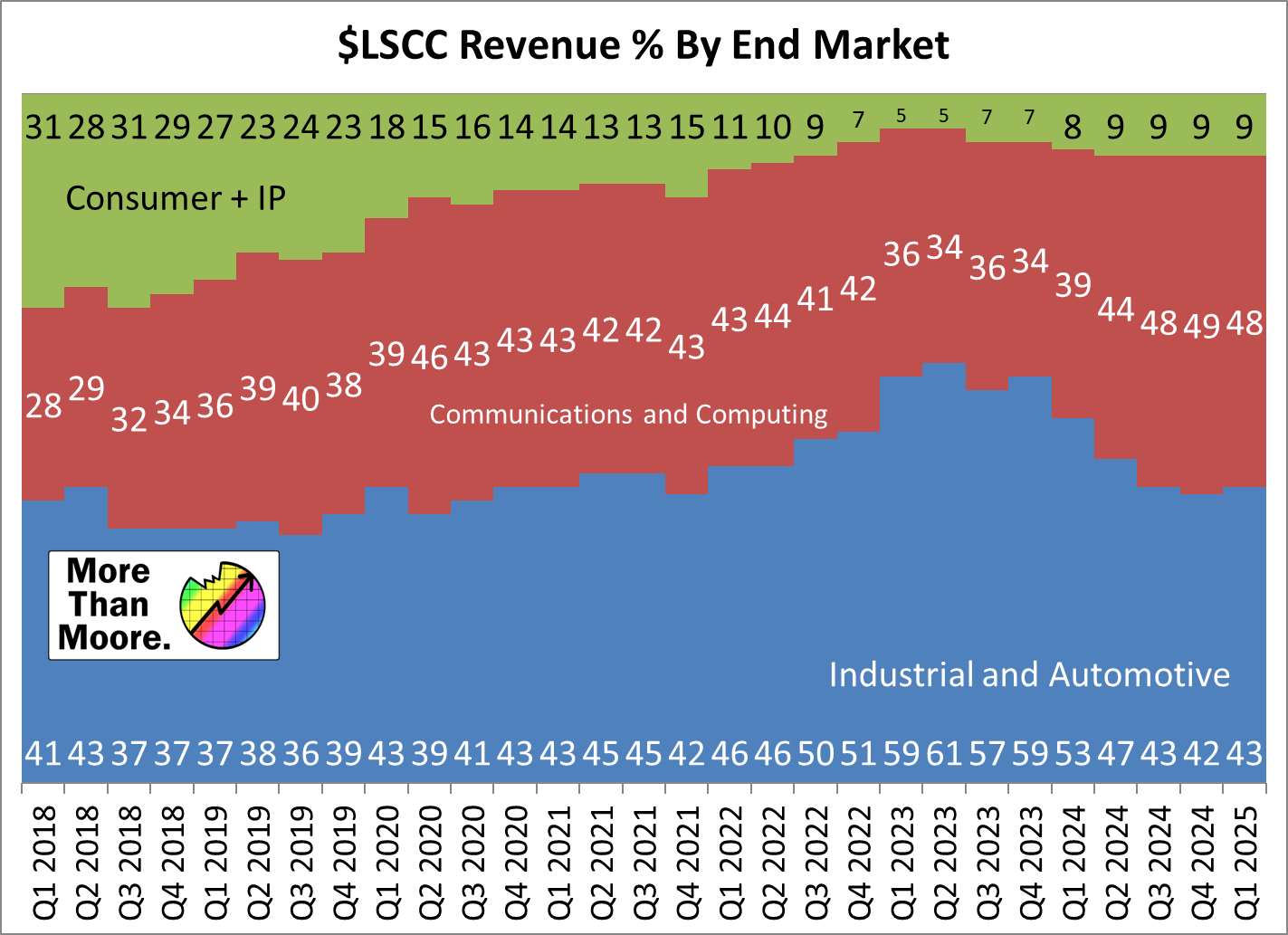

Communications and compute remained Lattice’s largest vertical, accounting for 48% of revenue this quarter. Industrial and automotive followed at 43%. Consumer, now just 9%, has shrunk to the point of near irrelevance in terms of growth impact. While the design win commentary hinted at AR/VR and robotics demand, the revenue contribution of those categories will take multiple quarters to show up at scale.

Asia remains the engine.

Sixty-five percent of Lattice’s Q1 revenue came from Asia, consistent with long-term geographic trends. Americas share ticked up slightly to 25%, the highest level ever. EMEA came in at 10%, down from 22% just two quarters ago, though Lattice has not signaled anything fundamental in the region to explain that drop.

Channel mix remains distributor-heavy.

Distributor sales made up 79% of revenue in Q1, a modest drop from last quarter’s 84% but still in line with Lattice’s historic mix. The one anomaly remains Q3 2024, when direct sales spiked to 95%, likely tied to timing or a specific customer ramp. Nothing in the Q1 results suggests a shift in go-to-market strategy.

Strategic Commentary

Lattice’s Q1 played out exactly as expected: small revenue uptick, gross margin recovery, and no major surprises on operating structure. But the bigger picture is less about the quarter and more about the lanes Lattice is choosing, and the stakes tied to getting them right.

CEO Ford Tamer pointed to a record level of design wins, concentrated around generative AI, robotics, ADAS, post-quantum crypto, and far-edge AI. These are all areas where small-footprint, low-power programmable logic can offer competitive advantages. Lattice is not trying to outgun high-end FPGA vendors on sheer performance. Instead, it is doubling down on efficient intelligence at the edge, where latency, thermal headroom, and power budgets are deal-breakers. This is where Nexus 2 comes in: a continuation of Lattice’s low-power leadership into higher bandwidth applications. Meanwhile, Avant gives Lattice a shot at the mid-range programmable market, a segment historically dominated by larger incumbents like Altera and AMD’s Xilinx.

In the datacenter, attach rates for Lattice parts are also trending upward. Historically used for control and system management roles, FPGAs are now appearing in higher-value sockets as AI infrastructure scales. The company is moving toward one or more attach points per server, particularly as power and telemetry demands grow. With Avant targeting mid-range complexity and Nexus 2 expanding bandwidth and I/O options, the opportunity to increase ASP per unit is starting to materialize.

The strategic bet is clear: stay small, stay nimble, and stay on the right side of power efficiency as AI moves into everything. But product bets are not revenue yet. The communications and compute segment grew just 5% YoY, while industrial and automotive fell 31%. The pivot to AI-aligned design wins has not yet translated into offsetting revenue streams. That could change as Avant ramps further, but visibility remains limited.

The company is also navigating a delicate balance on pricing and channel strategy. The rebound in gross margin back to 68% signals that product mix and ASPs are holding, even as volumes normalize. Distributor share came down slightly this quarter to 79%, possibly reflecting tighter control over end-market exposure or a softening in channel inventory. Either way, Lattice’s playbook of lean opex, focused R&D, and tight channel discipline remains intact.

The question now is time. Lattice is not overexposed to consumer swings, and it has no major capex burdens to unwind. But inventory remains high, and the ramp cadence of Nexus 2 and Avant will need to pick up to restore top-line momentum. In the meantime, Lattice continues to buy itself time with strong cash flow and margin discipline, two things the market still rewards even in a waiting game.

Outlook (Guidance for Q2 2025)

📦 Revenue: $118.5M to $128.5M

📈 Gross Margin (Non-GAAP): 69% ± 1%

📋 Operating Expenses (Non-GAAP): $50.5M to $52.5M

🏛️ EPS (Non-GAAP): $0.22 to $0.26

🌀 Management tone: Cautious, focused on execution over acceleration

Lattice is guiding Q2 revenue to a range of $118.5M to $128.5M, implying another modest sequential gain. Gross margins are expected to hold steady at 69% ± 1%, reinforcing that product mix and pricing remain favorable. Operating expenses will stay flat, with the company maintaining its cost discipline even as R&D ramps behind Avant and Nexus 2. EPS is forecast between $0.22 and $0.26, meaning profitability should improve even without a major topline surge. The message is clear: no breakout expected, but the company is operating from a position of control and waiting for design wins to convert into volume.

What to Watch

-

Avant revenue impact. Management continues to emphasize Avant in strategic commentary, but contribution to revenue is still opaque. Expect clearer signs of adoption, or lack thereof, over the next two quarters.

-

Nexus 2 traction. Nexus helped define Lattice’s low-power edge leadership. Nexus 2 needs to do the same under heavier workloads. Early wins in robotics and automotive are promising, but scale matters now.

-

Inventory normalization. Inventory days rose to 225 in Q1, another new high. The timing and pace of that unwind will determine how quickly gross margins can stabilize at or above 69%.

-

Channel signals. Distributor share declined to 79% after spiking in 2024. If this stabilizes or continues down, it could indicate more direct control over pricing, mix, or end demand visibility.

-

AI edge use cases. Design wins in post-quantum crypto, far-edge AI, and low-latency inference are not just future bets. They are Lattice’s differentiator. Watch how these translate into actual volume ramps, especially in industrial and automotive.

Also…

At the last Lattice Developer Conference 2024, I created this video on the event and the announcements in partnership with Lattice. Gives some insight into the direction of the company given the nature of the event.

I also interviewed Esam Elashmawi, Lattice’s Chief Strategy and Marketing Officer, about the future of the FPGA market.