I don’t normally do short stubs at 11:30pm on Christmas Eve, but a bulk of news just came across our collective laps and it’s worth at least mentioning my initial takes.

NVIDIA Pays $20B for Groq License + People

Based on this post here on Groq’s website:

NVIDIA and Groq have entered into a non-exclusive licensing agreement whereby NVIDIA will be able to use Groq’s hardware and architecture license. On top of that, the CEO of Groq, Jonathan Ross (no, not that one, this one was on the OG TPU team), and almost everyone of note from Groq will join NVIDIA.

Groq will remain an independent company, hold the IP, and service GroqCloud (it’s online neocloud business) with all the middle-eastern deals it has done over the years.

Further disclosure over at CNBC also tells us the deal is worth $20 billion USD, NVIDIA is acquiring all of Groq’s physical assets, just not the IP.

So what on earth is going on?

Who is Groq

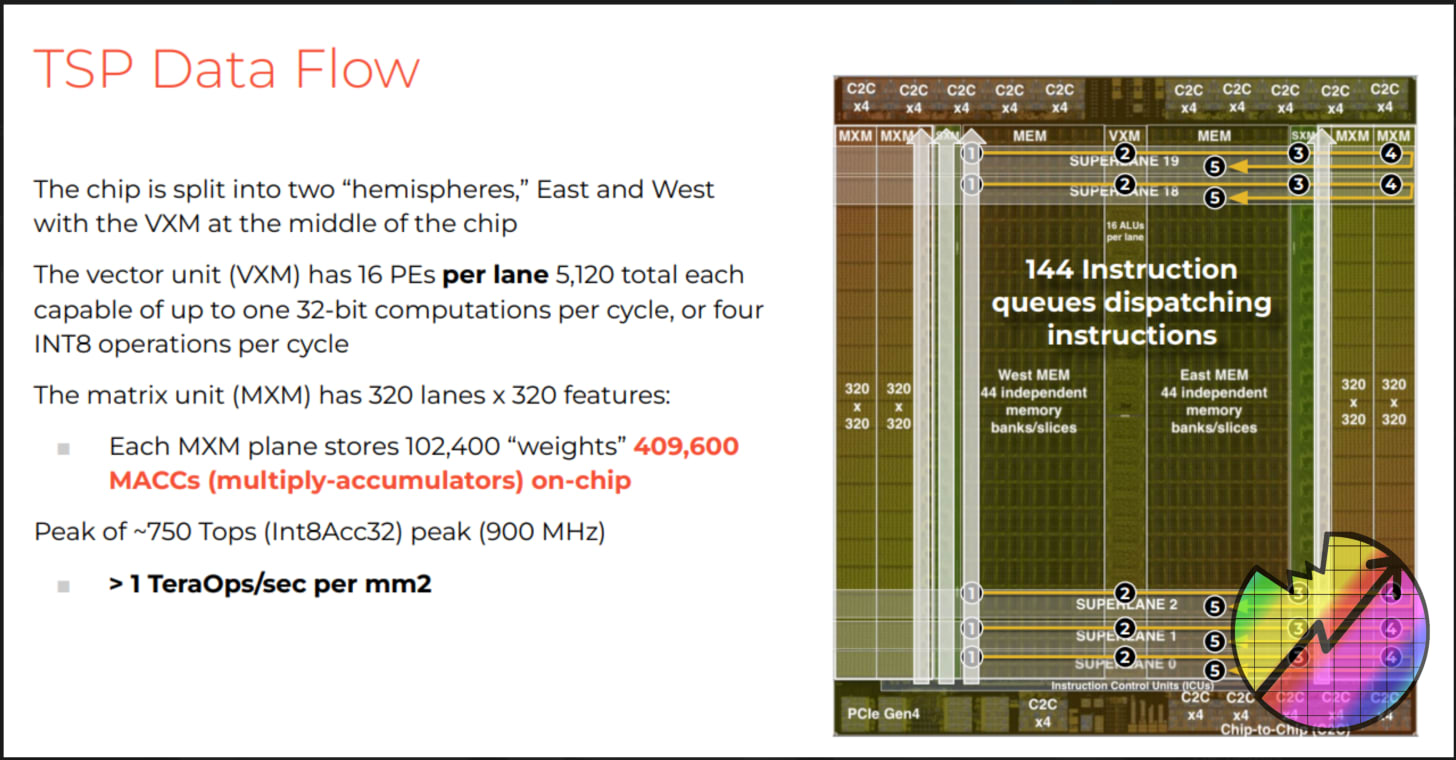

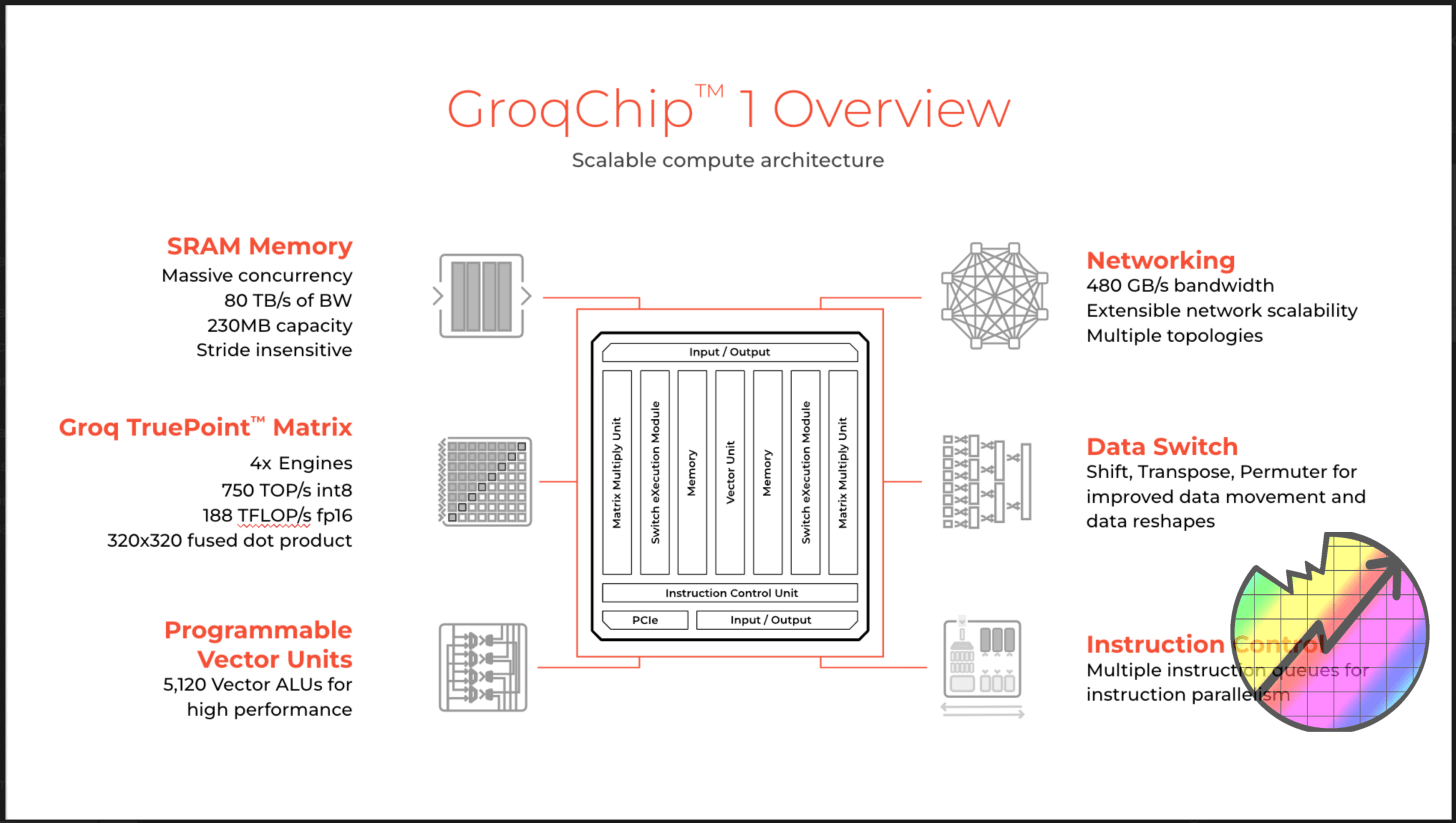

Groq is a company founded in 2016 that creates a product called the TSP, or Tensor Streaming Processor. It was later renamed to LPU, or Language Processing Unit, once LLMs and transformers became the flavor of the month. You might see it listed as GroqChip 1 in some documents.

This chip was released in 2019, and the CEO of the company, Jonathan Ross, hails from Google’s original TPU team. While Google’s TPU deals with large 8-way VLIW systolic arrays, the Groq chip is a large 144-way VLIW design, built at Globalfoundries, making it very cheap and easy to scale.

The downside of the chip is that it has no external DDR or HBM memory – only onboard SRAM. While fast, the 230 MB capacity per chip has been super low, and implies that a reasonably small open source model like Llama 70B requires 10 racks of processors and over 100 kW of power to run.

The upside of the chip is that it is really fast for single user inference – the architecture of the compute and the only-local memory provides some of the fastest single user token per second numbers on the market. Through its email lists, Groq has been promoting its high speed at scale for many months.

Groq were due to launch a second generation chip in 2025, with the CEO stating at a Samsung Foundry event in 2024 that there would be some revenue from its new SF4X (4nm at Samsung Foundry) design in 2025, before scaling in 2026. So far we haven’t seen evidence of this new chip in the market.

But to date, they have raised $1.8 billion dollars, including a $640m Series D in 2024 and a $750m Series E in 2025. That last one valued the company at $6.9 billion. In February 2025, Groq secured a $1.5 billion commitment from the Kingdom of Saudi Arabia for ‘expanded delivery of its advanced LPU-based AI inference infrastructure’. At that time 19,000 chips had been deployed in the region.

So what’s the $20b deal worth?

Let’s break it down into a few viewpoints.

The following is for paid subscribers only. I know most of my stuff is free for everyone, but this is breaking news worth a deeper look. If I get a chance to speak to anyone at Groq or NVIDIA about this on the record, I’ll let you know. We’ll also cover the Intel/NVIDIA 18A hubbub below the fold too.

If anyone from Groq or NVIDIA wants to speak, on or off the record, my DMs are open.

Even on Christmas.

Also for those of you subscribed to me over on YouTube, we’ll be covering this in an upcoming podcast.