At the time of writing, was up +8% to $41.22 after hours.

Following a rough-and-ready Q2 for Intel, and compounding on what has essentially been a turbulent year, the former 800lb gorilla of the chipmaking world is enjoying a much calmer Q3 year that has seen the company return to profitability. Although $INTC is still in the midst of their restructuring plan, as announced back in July by CEO Lip-Bu Tan, the bulk of those restructuring costs were accounted for in Intel’s Q2’25 earnings, and the company is set to navigate relatively calmer waters going forward as it continues to cut costs and headcounts to further slim down the company.

Providing some extra wind for Intel’s sails, the most recent quarter for the company saw several developments on the financial and business sides of matters that have served to reinforce the company’s balance sheets – a key target of LBT. Signing deals with NVIDIA, SoftBank, and even the US Government, Intel has received over $10b in total investments from the three groups in exchange for Intel’s arguably undervalued stock. The backing from both industry and government has provided a welcome respite from Intel’s earlier financial troubles, and it is a sign that the industry as a whole is willing to step up to support the unsteady chipmaker during its rough transition – and keep the sole local leading-edge chipmaker afloat.

The most recent quarter also saw Intel benefitting from the previously-announced sale of its Altera FPGA division, which has now become an independent company once again. With Silver Lake having acquired 51% of the company from Intel, Intel is now a minority stakeholder in the pure-play FPGA firm, all the while pocketing around $4.6b in cash from the sale for its balance sheets. Intel also divested further with Mobileye, at around $900m.

Key Takeaways (GAAP)

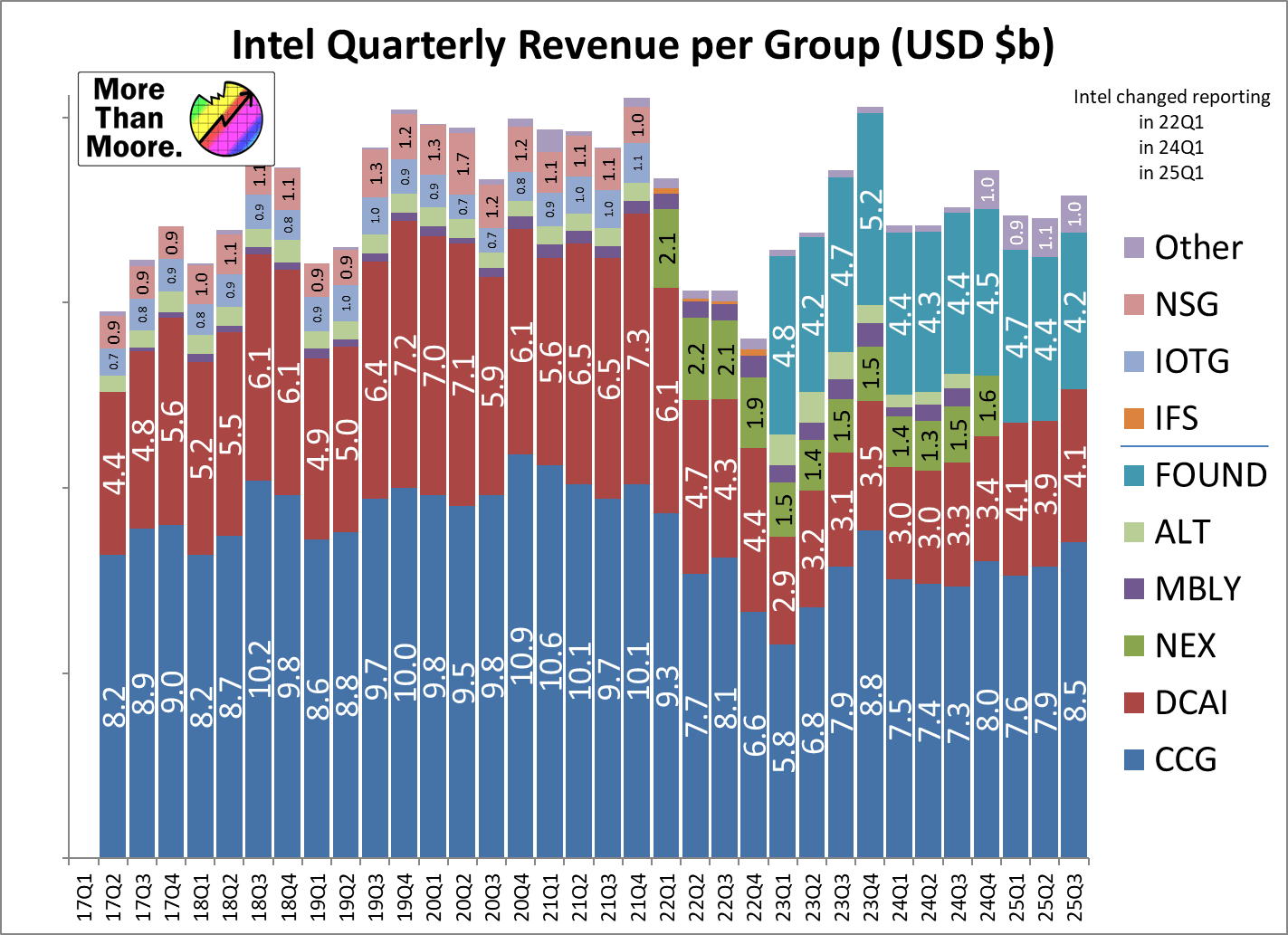

💵 Q3 Revenue, $13.7b, up 3% YoY from $13.3b and up 6% QoQ

📈 Q3 Gross Margin at 38.2%, up 23.2pp YoY and up 10.7pp QoQ

💰 Q3 Net Income of $4.1b, up 124% YoY from -$16.6b and up 239% QoQ

🪙 Q3 EPS $0.90, up 123% YoY, up 234% QoQ

Highlights

The third quarter of 2025 was a busy period for Intel’s executives and legal department, as the company penned several major deals for investments and joint product development. As well, Intel’s 18A ramp-up continues apace, as Intel gears up for the Q4 launch of its Core Ultra 3 (Panther Lake) mobile parts and 1H launch of Intel Xeon 6+ (Clearwater Forest) in enterprise.

-

In a fresh funding deal with the US Government, Intel’s previously awarded CHIPS Act grants have been converted into an equity stake investment for the US Government Altogether, the US is in the process of investing $8.9b in Intel in exchange for common stock, with Intel having received $5.7b from share purchases in Q3. Once the share purchases are completed, the US Government will own 9.9% of Intel – or about 433 million shares.

-

Separately, NVIDIA announced that it will be investing in Intel by buying $5b in common stock as new issuance.

-

And SoftBank is also joining the ranks of Intel shareholders, purchasing $2b in common stock.

-

Intel sold off a further 8% share of its stake in Mobileye, worth about $1b. The sale has reduced Intel’s stake in the ADAS company to around 80%.

-

On the product front, Intel and NVIDIA announced a joint collaboration that will see the two companies working together for both datacenter and consumer products. On the datacenter front, Intel will be developing custom x86 processors with NVLink connectivity for NVIDIA for AI systems. And on the consumer front, it is expected that NVIDIA will be making RTX graphics GPU chiplets available to Intel for integration into their x86 SoCs, or combine into a GB10 x86 variant.

-

Intel has also formed the Central Engineering Group, designed to span across the business when it comes to IP, test chip design, EDA tools, and design platforms. CEG will also be the hub of Intel’s future ASIC design business, allowing customers to leverage Intel’s chip design expertise and x86 IP.

-

Intel’s first high-volume 18A fab, Fab 52 in Arizona, is now fully operational. Fab 52 will be a critical component of the launch of Intel’s Core Ultra 3 (Panther Lake) generation of chips, which are Intel’s lead product for the 18A process.

-

Out of the announced headcount reduction, Intel has reduced down from 101.4k employees in Q2 to 88.4k employees in Q3, a 13.0k reduction. This includes 3.3k headcount from Altera divestiture.

Financial Overview

For the third quarter of 2025, Intel’s financial performance marked something of a return to form for the company, especially after the company’s brutal Q2’25 earnings and associated restructuring. With $13.7b in revenue for the quarter, Intel’s revenue was up 3% year-over-year, and 6% on a quarterly basis. Notably, this marks the third quarter in a row that Intel has beaten their quarterly revenue outlook, with Intel coming in about $100m ahead of their top-end estimate, and seemingly ahead of the street estimate, leading to the company being up 8% after hours.

Once we dive into margins and net income, however, things become far muddier. Because Intel undertook significant restructuring and other one-off charges in both Q2’25 and Q3’24 – under CEOs Lip-Bu Tan and Pat Gelsinger respectively – any of the usual quarterly or yearly comparisons are severely distorted by the unusually poor performance of those quarters. As a result, Intel’s Q3’25 performance is technically vastly improved over prior periods, but not by nearly as much as things seem at face value.

In any case, Q3’25 was a solidly profitable quarter for Intel, with the company booking $4.1b in GAAP net income on the back of both strong chip sales and Intel’s aforementioned sales of parts of its stakes in Altera and Mobileye. Gross margins also improved to 38%, the highest they’ve been all year for the company.

Otherwise, Intel’s non-GAAP performance is similar in scope. Non-GAAP gross margins were a bit higher at 40%, while non-GAAP net income was lower at just $1b – with the non-GAAP net income most notably excluding the profits from Intel’s Altera and Mobileye sales.

Meanwhile, it’s interesting to note that Intel’s R&D and administrative spending has dropped significantly over the past year, following two rounds of restructuring within Intel. On a GAAP basis, Intel spent just $4.4b on R&D and administration, which is down 20% ($1b) from their spending in Q3’24. Unfortunately, Intel doesn’t further split out R&D from administrative spending, so it’s not clear how much of these reductions have come from the former versus the latter – though Intel has previously made it clear they’re more heavily targeting admin spending.

Finally, it’s also interesting to note that the US Government’s investment into Intel has put the company in something of uncharted accounting waters, as underscored by a significant and lengthy disclaimer in the company’s Q3 earnings report. In short, there’s limited precedent for how to account for these transactions, and while Intel is taking what it thinks is the most correct approach to accounting for the deal, there are other ways to go about it. Intel has consulted with the US SEC on how to best go about this, but because the US Government has been shut down since the start of October, the SEC and Intel were unable to finish their consultation ahead of this earnings report. As a result, Intel is cautioning investors that the company may have to revise its Q3 earnings report if, once reopened, the SEC ultimately decides that Intel needs to employ other accounting methods.

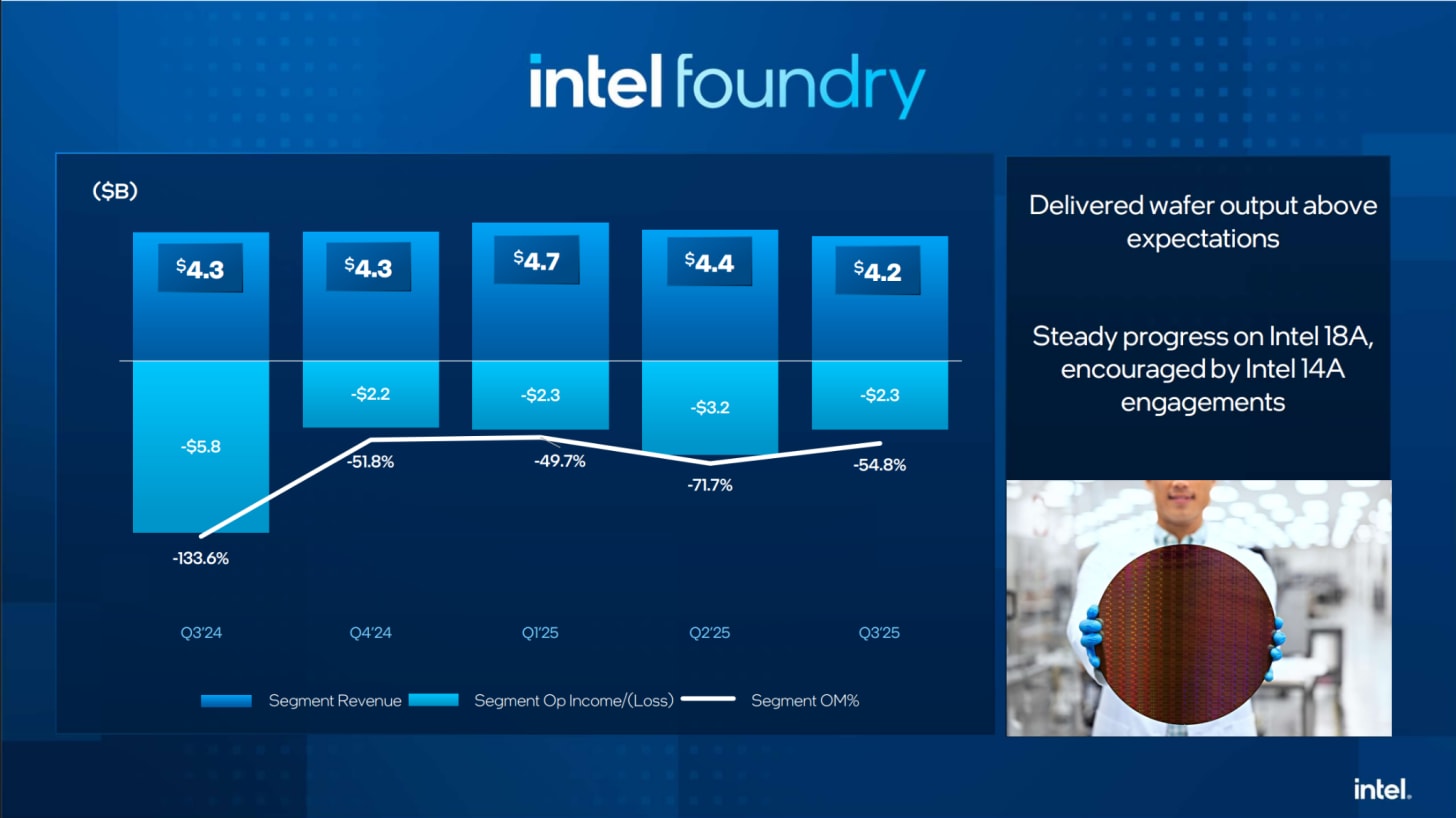

Intel Foundry

💵 Q3 Revenue $4.2b, down 2% YoY

💰 Q3 Operating Loss $2.3b, up from $5.8b loss YoY

📈 Q3 Operating Margin -54.8%, up from -133% YoY

The actual chip-making arm of Intel, Intel Foundry is continuing its slow transition from being an Intel internal fab to a contract foundry available to chip designers around the world. As instituted by Lip-Bu Tan earlier in the year, Intel Foundry is undertaking a cautious expansion into this market – a notable shift from Pat Gelsinger’s original, more aggressive schedule – though Intel Foundry’s roadmap remains relatively locked in place due to the years of lead time required to make changes.

On the whole, Intel Foundry’s finances are slow to move in either direction, and that’s once again the case for Q3’25. Over the last 5 quarters Intel Foundry’s revenue has been relatively stable, hovering around $4.4b per quarter. So have Intel Foundry’s operating losses, for that matter – the major one-off restructuring charges in Q3’24 aside, Intel Foundry is losing around $2.5b per quarter.

For the most recent quarter, Foundry’s performance has recovered after a dip in Q2 due to a write-down in fab assets. As a result, Foundry’s $4.2b of operating revenue and $2.3b operating loss for Q3’25 is a perfectly average quarter for the business from a financial perspective. As a reminder, Intel isn’t expecting the foundry business to turn break even for a while, and finally become profitable by the end of the decade.

As for Intel Foundry’s actual manufacturing operations, Q3 continues several trends that we also saw in Q2. Of particular note, Intel remains capacity constrained on its Intel 10 and Intel 7 process nodes. While Intel’s latest-generation products have moved on to newer nodes – be it Intel 3 or external TSMC products – Intel 7 is still heavily used for Intel’s classic Xeon and Core CPUs, which remain in high demand. Especially in the datacenter space, customers are slow to stop buying older chips (read: they want to be able to buy the same thing for several quarters), which is keeping the company’s Intel 7 fab lines very busy.

Side note here from Ian – some of this may be driven by the uptick in Windows 11 refresh cycles that is being seen industry wide to have accelerated. By keeping Intel 7 products in rotation, customers are demanding them over more cost-effective products for Intel. Intel has stated that despite high demand, they expect that demand to peak in Q1 especially as Intel’s own inventories are depleted. From then on, they expect customers to focus on the newer generations of higher margin products.

Nonetheless, Intel is reporting that for Q3 the company has beaten its internal expectations for wafer deliveries from Intel’s fabs. According to comments made on Intel’s earnings call, wafer shipments for both Intel 7 and the related Intel 10 process node were above expectations. Meanwhile, Intel had nothing specific to say about Intel 3 demand or wafer shipments. Either way, even if Intel is only exceeding expectations on an older node, it’s nonetheless a positive sign for Intel’s beleaguered fab.

Looking forward, Intel is also ramping up its shipments of wafers built on its brand-new 18A process node. With Fab 52 now fully operational, Intel now has a high-volume fab for producing 18A wafers. Even with the recent change in leadership, the 18A node family remains a critical offering for Intel Foundry, as it marks the introduction of multiple new technologies, most notably gate-all-around (GAAFET) transistors, and backside power delivery networks (BSPDN), which Intel believes will give them a critical competitive edge over TSMC.

There are some mixed messages from Intel on how much 18A capacity they’re installing over the near term, however. In the company’s post-earnings Q&A with analysts, CFO David Zinsner noted that analysts shouldn’t “expect capacity increases in the near term” for Intel’s 18A capacity in Arizona, and later clarified that the capacity is still ramping as expected, but there wouldn’t be any additional capacity beyond. Intel expects most of 18A wafers to be consumed internally in 2026, and can more accurately predict demand as a result. David also stated that in order for 18A to be cost efficient for external customers, 2026 is expected to show good progress in that direction to where 2027 will be cost competitive.

Finally, while Intel has no significant updates to offer on the development of 14A at this time, the company is reiterating that it is “encouraged” by the number of engagements they’ve had from external chip designers and that the health of the yield numbers is a lot better than 18A was at a similar point in its lifecycle.

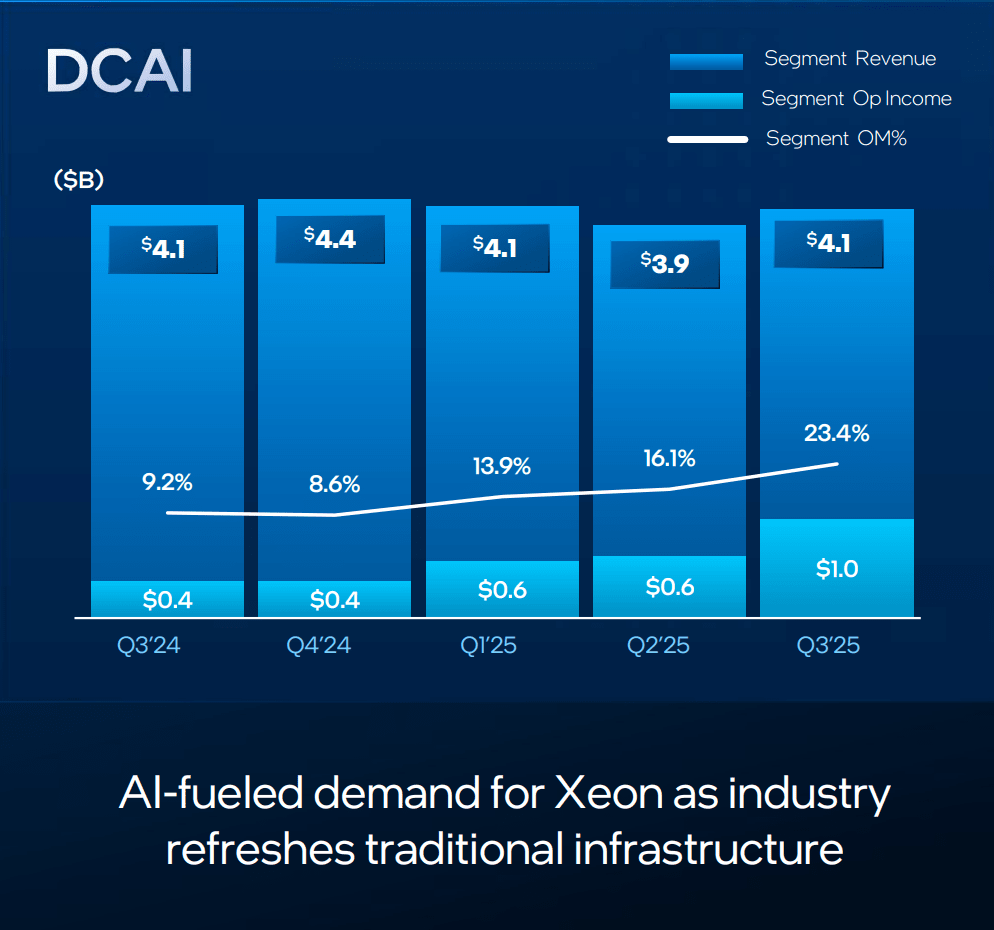

Data Center and AI (DCAI)

💵 Q3 Revenue $4.1b, down 1% YoY from $4.1b

💰 Q3 Operating Income $964m, up from $381m YoY

📈 Q3 Operating Margin 23.4%, up from 9.2% YoY

The first of Intel Products’ two top-line chip businesses, DCAI has in recent years been the more volatile of Intel’s chip business due to a combination of corporate buying cycles and increasingly stiff competition from AMD and numerous Arm architecture chip designers. In good years, DCAI is the most profitable portion of Intel’s portfolio, so the health of this business unit is critical to Intel’s overall operations.

On a yearly basis, DCAI revenue is just below being flat, with the $4.1b in quarterly revenue marking a 1% decrease over Q3’24. Otherwise on a quarterly basis, revenue has increased by 4.5%.

More significant has been the slow but consistent recovery of DCAI’s operating income and associated operating margins. With the operating income for the group recovering to just shy of $1b for Q3, DCAI’s operating margin is back above 20%, hitting 23.4% in the most recent quarter. This still leaves a long way to go for the division to recapture its past glory – and as we’ll see, it’s still below the margins for client products – but it’s the kind of turnaround in data center and AI products that Intel has been working hard over the past several quarters to engineer.

Finances aside, Intel has relatively little to say about the DCAI unit for the most recent quarter. With regards to Xeon sales, Intel reports that they’re seeing a more “preferable mix” of sales there, with a shift towards more profitable parts. Overall, Intel is expecting pretty smooth and predictable growth here, as customers in the data center CPU segment are making longer-term commitments over several quarters.

While Intel is very much on the outside looking in on the AI market in terms of accelerators, the seemingly unrelenting demand for AI systems means that customers are also continuing to ramp up their purchases of Xeon CPUs to use as host CPUs in those AI systems. So Intel’s boat is still being lifted by that rising tide – if more slowly than others.

Finally, while still a very forward-looking product announcement from Intel, earlier this month revealed the first of its next-generation AI accelerator products: Crescent Island. Expected to be released in H2’26 – around a year from now – Crescent Island is an inference-optimized AI accelerator that is based on a variation of Intel’s Celestial (Xe3P) microarchitecture. The accelerator will be paired with 160GB of LPDDR5X memory, underscoring that this is a higher-volume efficiency-optimized part, as opposed to the large, flagship-class parts such as the outgoing Xe-HPC (Ponte Vecchio) based Max accelerators.

Another note from Ian. Crescent Island is somewhat out of left-field for Intel. Previously its AI accelerators were built using IP from its Habana acquisition and team, which culminated in big datacenter chips called Gaudi and smaller inference designs called Greco and Goya. Intel mothballed the smaller inference designs some years back, and rather than call upon that team to create a new chip in a similar design, they’ve instead repurposed their graphics IP for datacenter inference. Intel has been working on accelerating its GPU IP for machine learning for a few years now, and given that Gaudi 3 will be the last Gaudi before the ‘Shores’ line of high-performance hardware is expected to kick in 2027, we have to consider that Intel may coalesce all of its machine learning hardware under a single line of IP – that being the GPU IP. It would mean that the Habana family architecture, which could never be integrated into Intel’s software stack seamlessly without shim layers, might truly be EoLed.

Client Computing Group (CCG)

💵 Q3 Revenue $8.5b, up 5% YoY from $8.2b

💰 Q3 Operating Income $2.7b, down from $2.9b YoY

📈 Q3 Operating Margin 31.6%, down from 36.0% YoY

The current breadwinner amongst Intel’s business units continues to be the Client Computing Group. While CCG is not enjoying the same kind of operating income growth as DCAI is – operating income is down on a yearly basis – it’s still Intel’s biggest business unit by far, booking $8.5b in revenue for the quarter. Compared to the year-ago quarter, this is up 5%, or around 8% versus the previous quarter. Meanwhile operating income stands at $2.7b (just under 3x DCAI’s), having hit its highest value all year for Intel.

Q3 is typically an important quarter for CCG in regards to product volume, and that’s especially the case in 2025. First and foremost is the seasonal holiday rush, which sees OEMs stocking up on chips to get laptops and desktops onto store shelves. Intel is expecting to see 100 million units shipped for the year.

Meanwhile the other big driver here is the impending launch of Intel’s Core Ultra 3 family of chips, which are based on the new Panther Lake architecture. While all signs point to the Panther Lake launch being December 31st to make it into 2025, they aren’t going to ship a ton of the 18A chips immediately as it takes several quarters to fully ramp. Nonetheless Panther Lake will mark an important milestone for Intel in terms of technology and competitiveness. Panther Lake should also be good news for Intel’s profit margins, as while there are ramp-up costs to defray, moving compute tile production from TSMC and back to Intel’s fabs will be a boon to Intel Product’s costs while also bringing new business to Intel Foundry.

Past this, Intel is also the beneficiary of the (first) retirement of Windows 10, which has seen Microsoft drop support for chips older than Intel’s 8th Generation Core (Coffee Lake) processors. As a result, the PC industry as a whole has seen PC sales pick up as older systems are retried and replaced with Windows 11-compatible gear. Intel is also citing interest in AI PCs as a contributing factor to the growth of the CCG business, though the company isn’t providing any detailed guidance on revenue share or the number of AI PC (Meteor/Lunar/Arrow Lake) chips they’ve sold.

As noted earlier, Intel 7 remains capacity constrained, thanks in part to high demand for Raptor Lake chips as a budget option. As a result, Intel hasn’t been able to sell as many chips as they would like – although the chip sales the company is missing out on are predominantly lower margin parts. Either way, the company is constrained enough that it is raising prices on Raptor Lake client chips, with Intel looking to shift “demand toward products where we have supply and they [OEMs] have demand.”

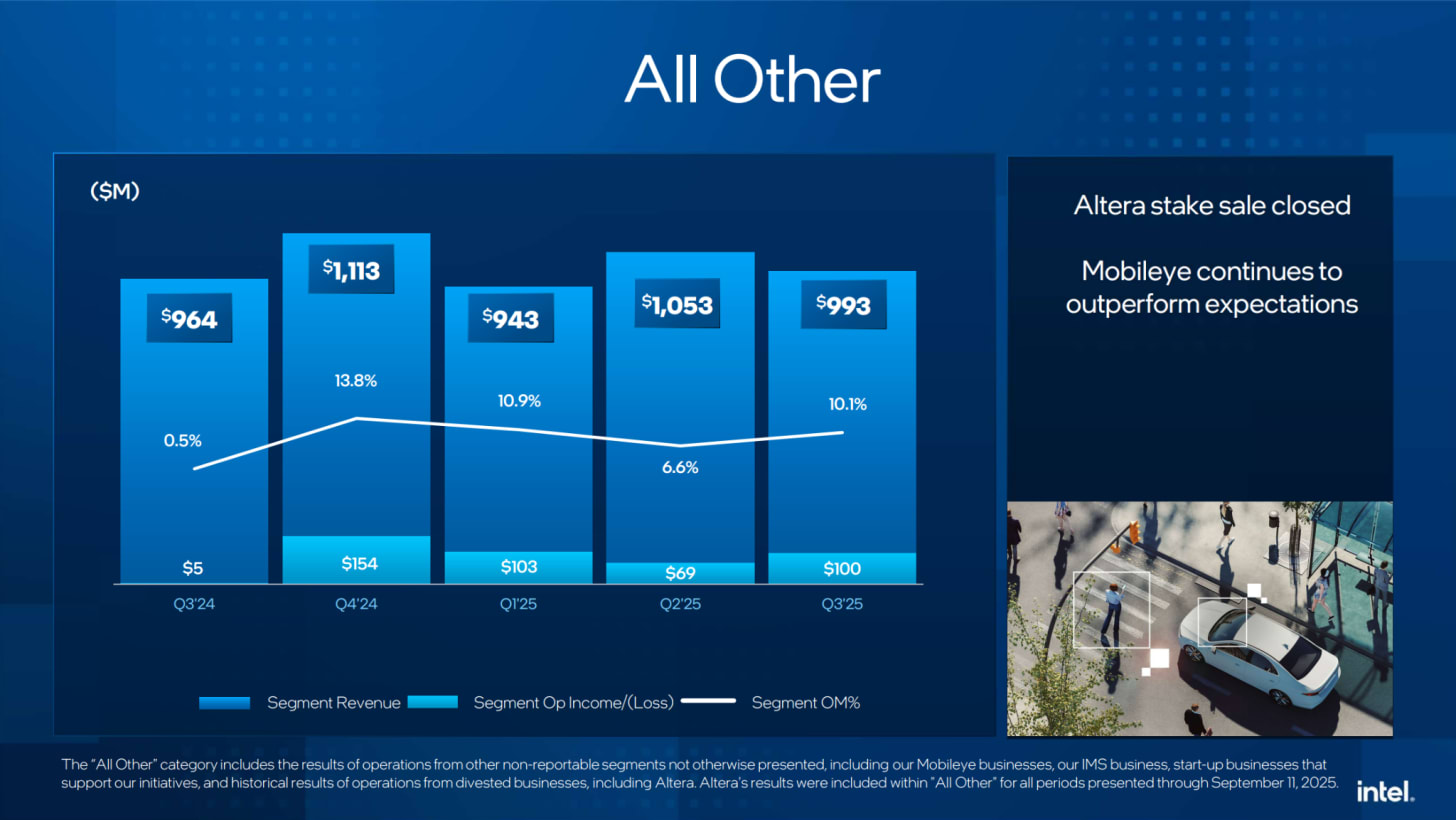

All Other (Altera, Mobileye, etc)

💵 Q3 Revenue $993m, up 3% YoY from $964m

💰 Q3 Operating Income $100m, up from $5m YoY

📈 Q3 Operating Margin 10.1%, up from 0.5% YoY

Intel’s final, catch-all business unit is ‘All Other’, which houses Mobileye (80% ownership*), IMS Nanofabrication (68%), and other majority-owned businesses.

This is also the business unit that held Altera up to September 12th, when Intel divested itself of 51% of the company. While Intel still owns the remaining 49% of Altera, Altera is now an independent company, and as a result it is getting deconsolidated from Intel’s earnings report. As a result, the Q3 earnings report is something of a transitory period for the All Others business unit, as it only reflects Altera’s revenues and operating incomes up to the point where it was divested. Going forward, Intel’s Altera holdings will no longer be reported as part of the All Others business unit, and instead will be accounted for as part of their broader investment holdings.

With regards to Intel’s finances, the sale of Altera is something of a mixed bag for the company. While the sale of their 51% stake brought in nearly $4.6b for the company – contributing heavily to their total $5.2 in divestiture sales for the quarter – the consequence of that is that Intel won’t have the revenue and operating income from Altera going forward. And Altera was a profitable group in recent quarters, contributing to company margins. CFO Dave Zinsner said that the loss of Altera will be about a point on margins going forward.

By the numbers, for the most recent quarter the All Others business unit booked $993m in revenue, which is up 3% YoY and down 6% QoQ. Of that revenue, $386m came from Altera for the 10 weeks it was still part of Intel. Meanwhile operating income for the quarter was $100m, which is up massively versus Q3’24, but is roughly average with the business unit’s operating income over the past four quarters.

With Altera out of the picture, Mobileye is now the gem of the All Others group. While Intel has slowly divested itself of some of its Mobileye holdings as well- bringing the company down from 88% to 80% – Mobileye’s profits are Intel’s profits. And, according to Intel, Mobileye continues to outperform Intel’s expectations.

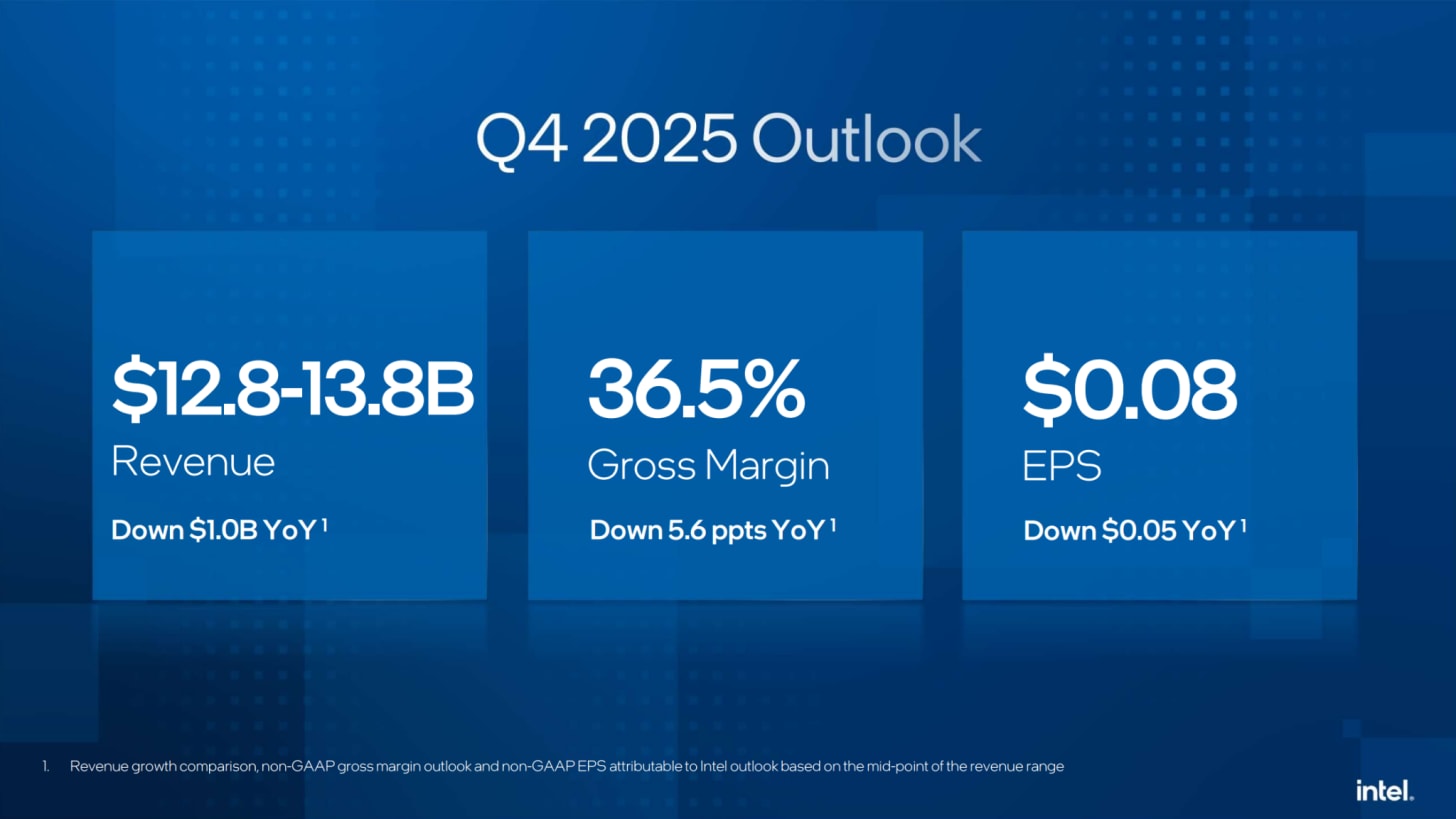

Outlook, Q4 2025

💵 Q3’25 Revenue, $13.3b, +/- $500m

📈 Q3’25 Gross Margins of 34.5% (GAAP) and 36.5% (non-GAAP)

Looking forward to the rest of 2025, Intel is currently forecasting a mixed quarter that will likely see total revenues and gross margins decline from the most recent quarter in real value, although Intel is pointing out that these numbers do not include Altera. If Intel outperforms its own outlook in Q4 as it has for the rest of the year, then it would stand a good chance of beating its Q3 performance.

A major impact here is again the Altera sale, with Intel no longer booking the hundreds of millions of dollars in revenue that Altera previously brought in. Otherwise, if Altera were factored out of Intel’s Q3 earnings entirely, then Intel expects that Q4 revenue will be flat relative to an Altera-less Q3.

As for gross margins, both GAAP and non-GAAP margins are forecast to decline slightly as well. Q4’24 was a relatively strong quarter for Intel when looking at the last several quarters, so its 39% GM is a bit hard to catch up to; at this point Intel is just trying to hold things steady amidst the launch of Panther Lake, whose initial ramp-up will impact Intel’s margins.

Intel is also offering limited revenue guidance for its major business units for Q4 to help paint a more detailed picture. Intel’s official forecast is for CCG revenue to be down modestly, as Intel is prioritizing Intel 7 wafer shipments for server parts over cheap client parts. Conversely, DCAI revenue is forecast to be up strongly on a sequential basis for the same reason, as Intel churns out more server chips.

Intel Foundry revenue is also expected to grow on a sequential basis, as Intel books its first 18A revenue. As well, the divestiture of Altera – whose leading products are all built on Intel 10 and Intel 7 – means it is now an external customer of Intel and will be booked accordingly.

Finally, with Intel having inked several investment deals over the recent quarter, the company is also providing investors with an update on the number of shares of common stock they expect to be in circulation after all of these deals close. Once all is said and done, Intel expects the company to have a diluted share count of 5 billion shares at the end of Q4, up from 4.5 billion at the end of Q3, and 4.4b at the end of Q2.

More Than Moore, as with other research and analyst firms, provides or has provided paid research, analysis, advising, or consulting to many high-tech companies in the industry, which may include advertising on the More Than Moore newsletter or TechTechPotato YouTube channel and related social media. The companies that fall under this banner include AMD, Applied Materials, Armari, ASM, Ayar Labs, Baidu, Bolt Graphics, Dialectica, Facebook, GLG, Guidepoint, IBM, Impala, Infineon, Intel, Kuehne+Nagel, Lattice Semi, Linode, MediaTek, NextSilicon, NordPass, NVIDIA, ProteanTecs, Qualcomm, Recogni, SiFive, SIG, SiTime, Supermicro, Synopsys, Tenstorrent, Third Bridge, TSMC, Untether AI, Ventana Micro.

Below the fold is for paid subscribers only.

It includes all the Lip-Bu Tan prepared remarks as well as the Analyst Q&A.

You could probably get these transcripts elsewhere, but that’s not here, is it? 🙂