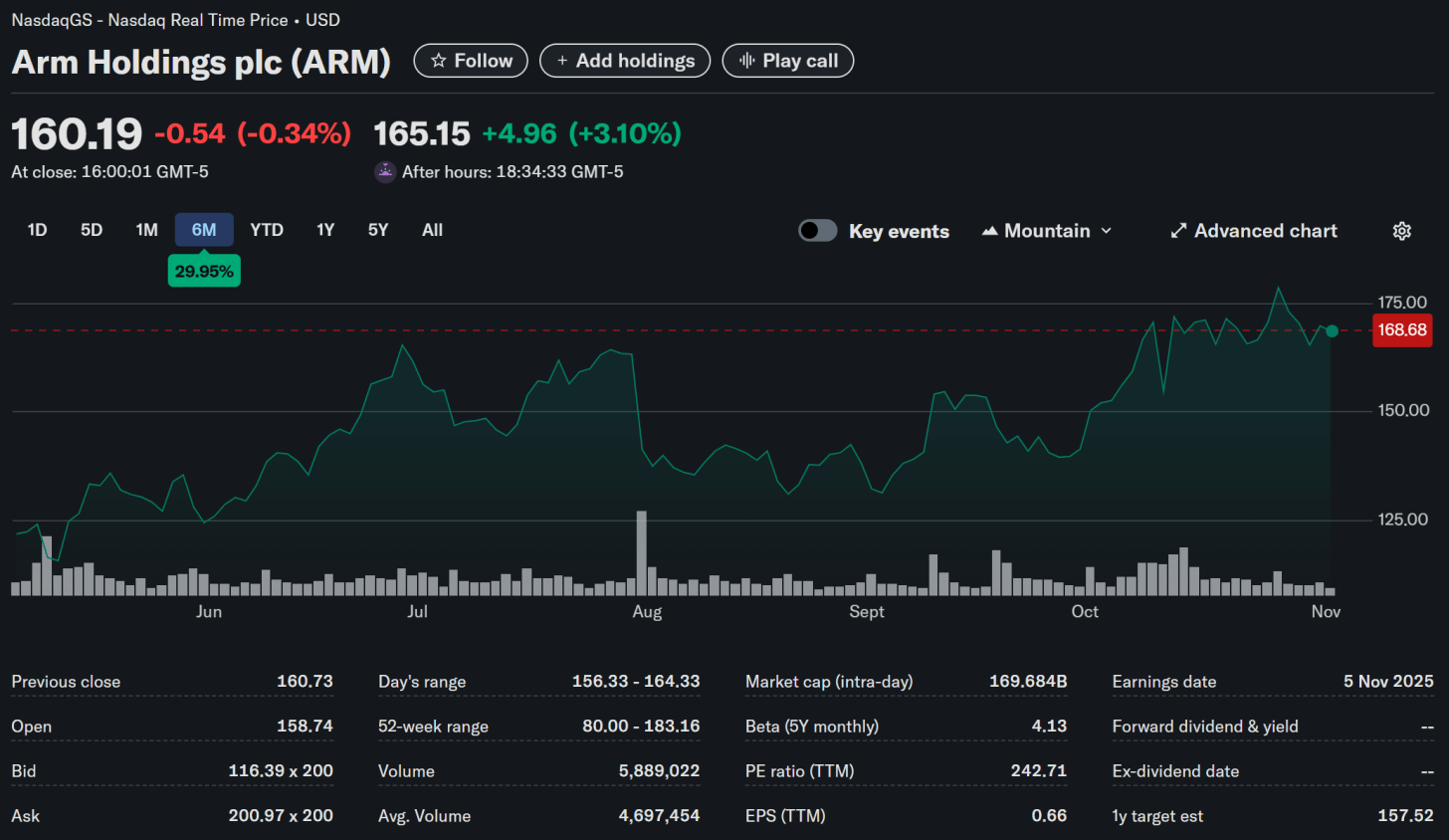

As the backbone IP provider behind chips big and small – with an increasing emphasis on the former – has been on a tear the last several quarters. With the company repeatedly setting revenue records over the past couple of years, Arm has continued to enjoy the broad growth in demand for all things chips, from smartphone SoCs on up to datacenter CPUs backing the most powerful AI accelerators. And the second quarter of their 2026 fiscal year has been no exception.

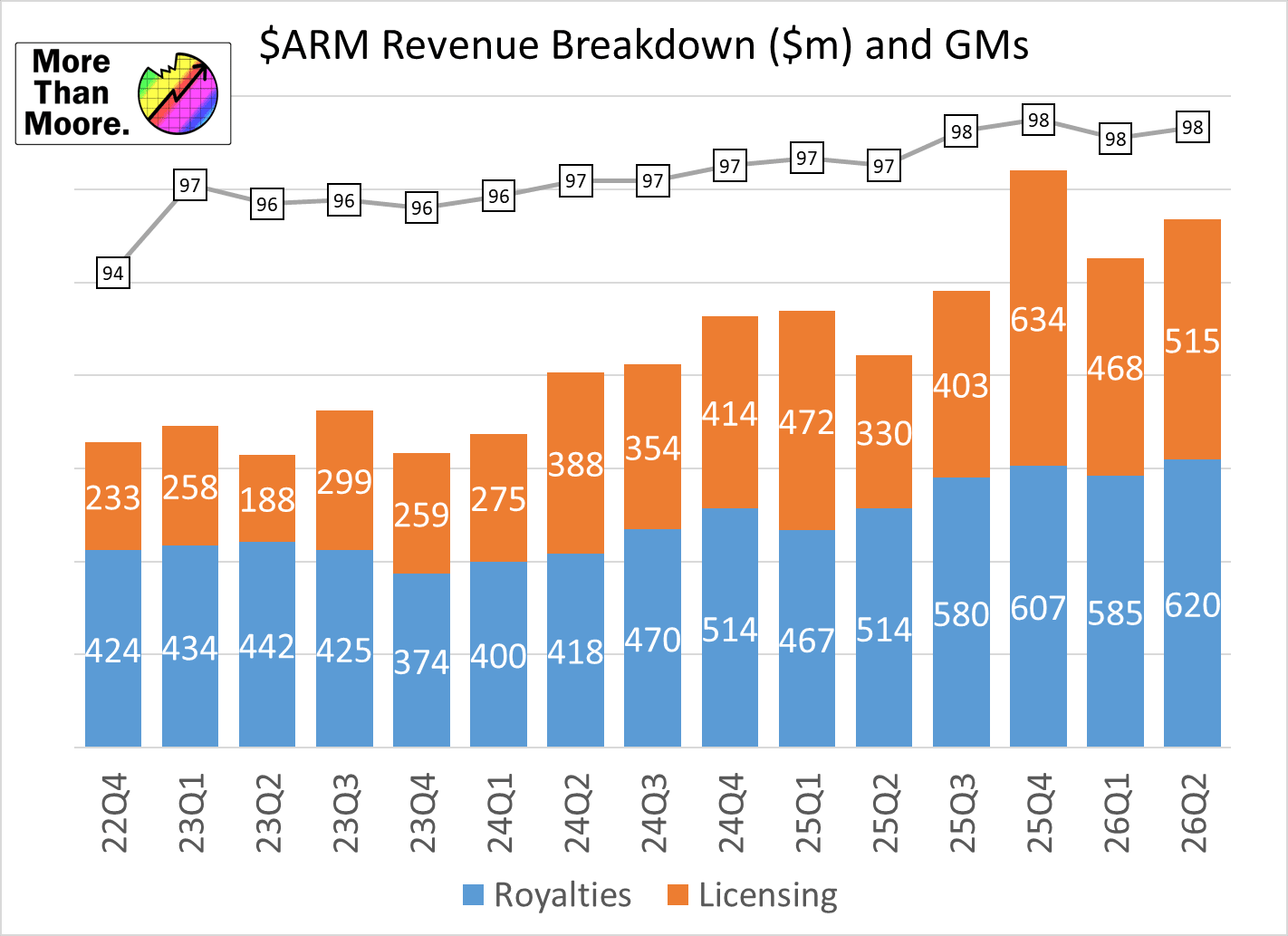

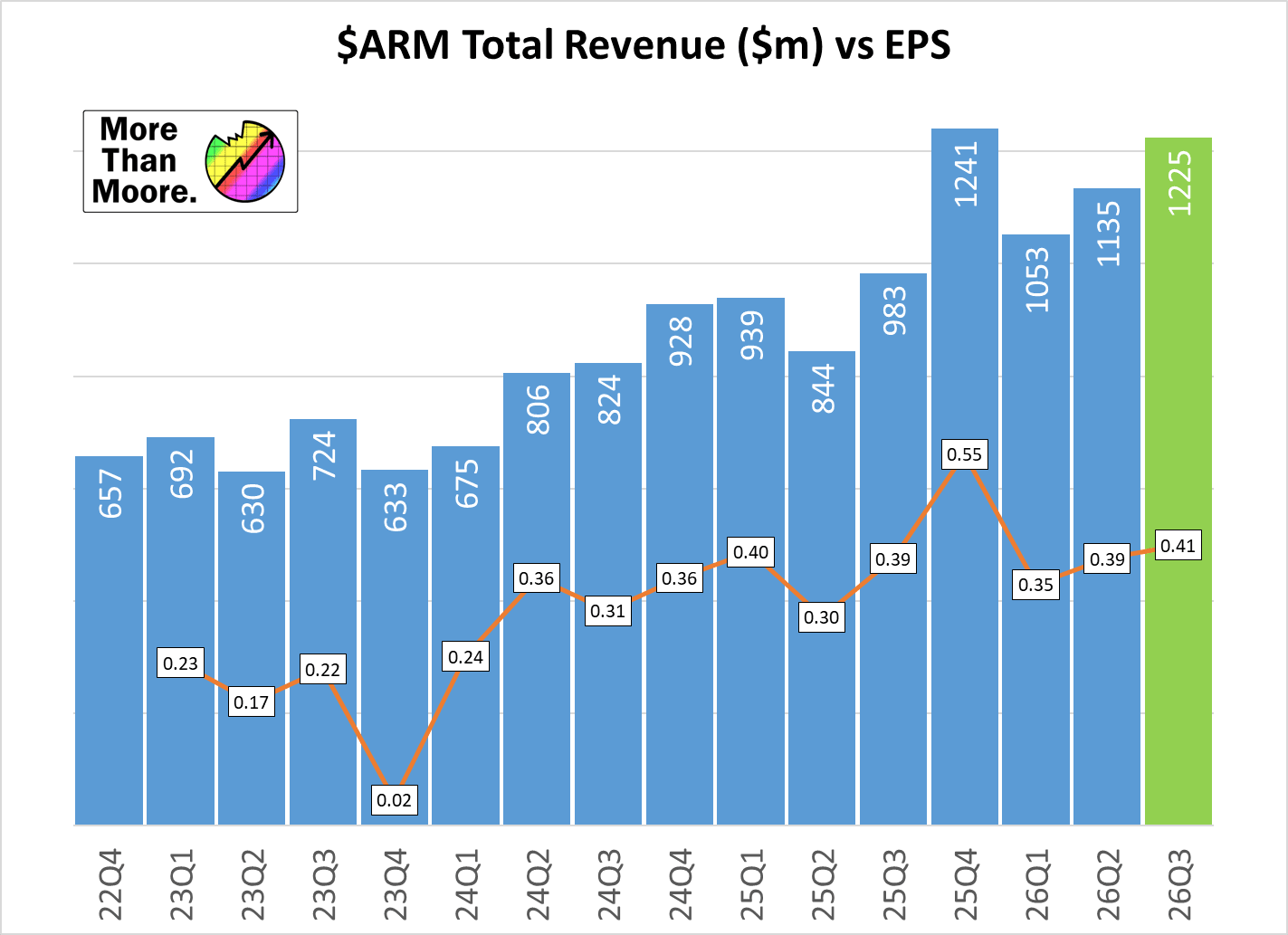

With $1.14b in revenue for Q2’FY26, Arm has once again set a new high-water mark for Q2 revenue. We’ll break things down in a bit, but in short revenue was up a hefty 34% year-over-year, with both licensing and royalty revenues delivering double digit growth of 56% and 21% respectively. Overall, this marks what is now the third quarter that Arm has booked over a billion dollars in revenue, with a consecutive run reaching back to Q4’FY25.

Overall, Arm’s situation remains pretty consistent from quarter to quarter, though this latest quarter was a bit richer in licensing revenue than most. While the IP business overall is more insulted from immediate market swings – and thus more consistent than what the hardware vendors themselves can see – Arm has nonetheless been pushing hard to expand its own revenue generating opportunities over the past couple of years. And those efforts are paying off with both new licensees and richer royalty rates. Coupled with the higher margins afforded by pre-assembled Compute Subsystems (CSS) IP blocks, it has set up Arm rather well for continued revenue growth.

Arm has also been a significant beneficiary from the AI boom, of course. While the company does not provide high-end AI accelerators of its own, the company is providing the architecture used by many of the CPUs driving AI systems, and this is something Arm is very quick to crow about in the current AI-heavy investment market. As a result, Arm has found itself in the lucrative position of selling important IP to the pickaxe makers of the AI market, such as NVIDIA, AWS, Microsoft, and others.

Key Takeaways (GAAP)

💵 Q2 Revenue, $1.14b, up 34% YoY from $844m and up 8% QoQ

📈 Q2 Gross Margin at 97.4%, up 1.2pp YoY and up 0.2pp QoQ

💰 Q2 Net Income of $238m, up 122% YoY from $107m and up 83% QoQ

🪙 Q2 EPS $0.22, up 120% YoY, up 83% QoQ

Highlights

-

Record Q2 revenue – second best quarter ever

-

Record R&D investment of $466m (non-GAAP), up 45% year-over-year

-

Launched 2025 smartphone CSS platform, Lumex. This includes the C1-Ultra, C1-Premium, C1-Pro CPU, and C1-Nano core designs, and Mali G1 family of GPU designs

-

Neoverse, Arm’s lineup of CPU core designs for the datacenter and edge, has surpassed 1 billion cores deployed

Financial Overview

For the second quarter of their 2026 fiscal year, Arm booked $1.14b in revenue. This was a hefty 34% increase year-over-year, setting a new Q2 record for the company. And while it didn’t set a new overall record – that belongs to Arm’s especially strong Q4’FY25 – it does mark the third quarter of revenues over the billion-dollar mark.

Because of the pure play nature of Arm’s IP business, virtually all of the company’s gross income is profit, and Q2’FY26 is no exception. For the quarter Arm recorded a GAAP gross margin of 97.4%, a 1.2pp increase over Q2’FY25. Meanwhile, Arm’s net income has rebounded after sliding in the past couple of quarters; with $238m in GAAP profits, Arm’s net income is up 122% year-over-year, and 83% on a quarterly basis.

This also means that Arm has handily beaten its previous Q2 guidance, which at the top-end of the guidance window called for $1.11b in revenue and a non-GAAP EPS of $0.37. Unlike the company’s broader earnings, Arm isn’t attributing the better-than-expected Q2 performance to any one element, though as licensing revenue is normally very predictable, I wouldn’t be surprised to find out that royalty revenues came in higher than expected and account for most of the extra $25m in revenue that Arm booked.

Digging into Arm’s financials a bit more, in previous quarters we’ve seen Arm’s overall profitability dogged by the company’s investments into R&D, which have been consistently ramping up. In fact, this most recent quarter has not only set new records for revenue, but it also marks a new R&D spending record as well at $466m (non-GAAP), a 45% year-on-year increase. The difference from past quarters being that Arm’s revenue has more than caught up with its R&D spending, allowing the company to continue ramping up R&D spending while still delivering over $225m in profits, making it one of their most profitable quarters ever.

As with prior quarters, Arm’s spending share-based compensation (SBC) continues to be worth keeping an eye on. Of the $691m in GAAP R&D costs for the quarter, $197m of that (33%) was in share-based compensation. All of which indicates that Arm is still operating a bit more like a startup right now, with a significant amount of its compensation going out in the form of stock. Most companies use this as a way to retain talent, so it’s worth keeping an eye on. Arm no longer updates its employee count quarter-to-quarter, we’ll get an update at the end of the fiscal year.

Licensing and Other Revenue

💵 Q2 Revenue $515m, up 56% YoY

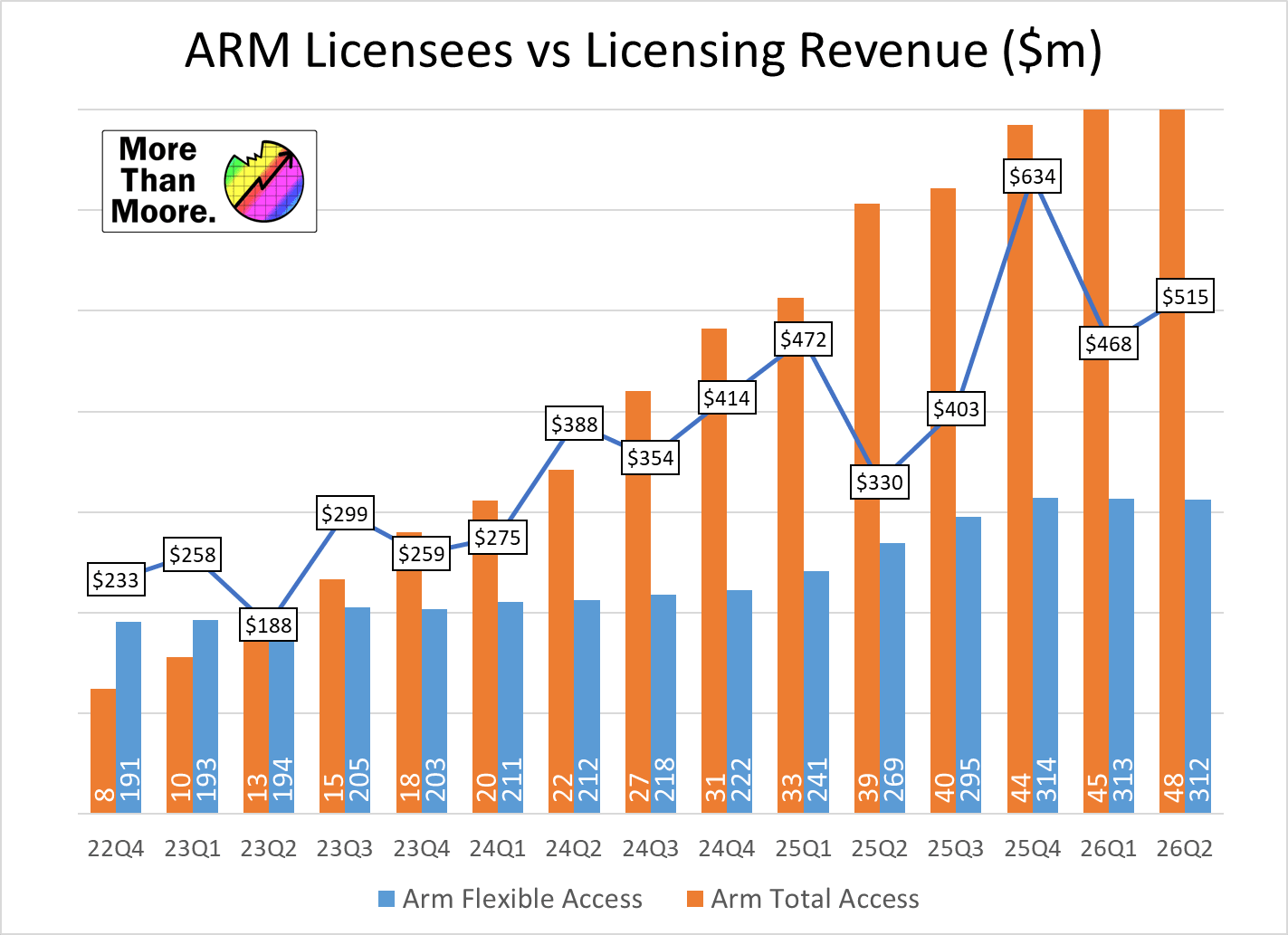

With Arm breaking down its revenues into two groups, licensing and royalties, we’ll once again start with the more volatile of Arm’s two business categories. As it’s not directly tied to hardware shipments or other client hardware success, it varies quite a bit based on when companies sign new or updated license agreements.

Overall, licensing revenue was up 56% year-over-year for Arm, with the company collecting $515m in license revenues. Like most quarters, Arm is broadly attributing the year-over-year change to “normal fluctuations in the timing and size of multiple high-value license agreements and contributions from backlog.” While Arm’s licensing revenue grows more often than it shrinks, the overall volatility of the business means that Arm can waiver between a slight decline in license revenue to a big leap, which is essentially what has played out in Q1 and Q2 of their 2026 fiscal year. So despite the 56% jump versus the year-ago quarter, it’s merely business as usual for Arm’s licensing operations.

Digging into Arm’s overall license sales, Arm is reporting that they’ve sold 3 new Arm Total Access licenses for the quarter, bringing the total to its all-encompassing license plan to 48 active (extent) clients. Meanwhile the company has lost 1 of their R&D-focused Arm Flexible Access licensees, bringing that total down to 312. Like licensing revenue itself, this is the more volatile of Arm’s licensing plans, and this is the fourth time in the last few years that Arm overall has lost a Flexible Access licensee going from one quarter to the next.

Finally, Arm’s CSS licensing program has picked up multiple new customers. The company signed 3 additional licenses in Q2 – one for smartphone chips, one for datacenter chips, and in a rare event, one for tablets. This brings Arm to a total of 19 CSS licenses spread over 11 companies, which is one more company than in the previous quarter. Altogether, this brings the running total to 11 compute licenses, 7 infrastructure licenses, and 1 automotive license. Furthermore, according to the company, at this point the top 4 Android phone vendors – including Samsung – are shipping CSS-powered devices, underscoring the significance of the CSS program to the smartphone market.

On that note, it’s interesting to observe just how quickly Arm’s new Lumex CSS platform has already appeared in shipping devices. Announced just in Q2’FY26, Arm is already expecting the first Lumex-based phones to launch this quarter from OPPO and vivo. Time-to-market is one of the key points of CSS, and while the announcement date for Lumex is somewhat arbitrary – Arm made their annual client CSS announcement later than usual for 2025 – they still consider it a feather in their cap that a customer was able to get a Lumex CSS-based design out the door so quickly, and already contributing revenue.

Royalty Revenue

💵 Q2 Revenue $620m, up 21% YoY

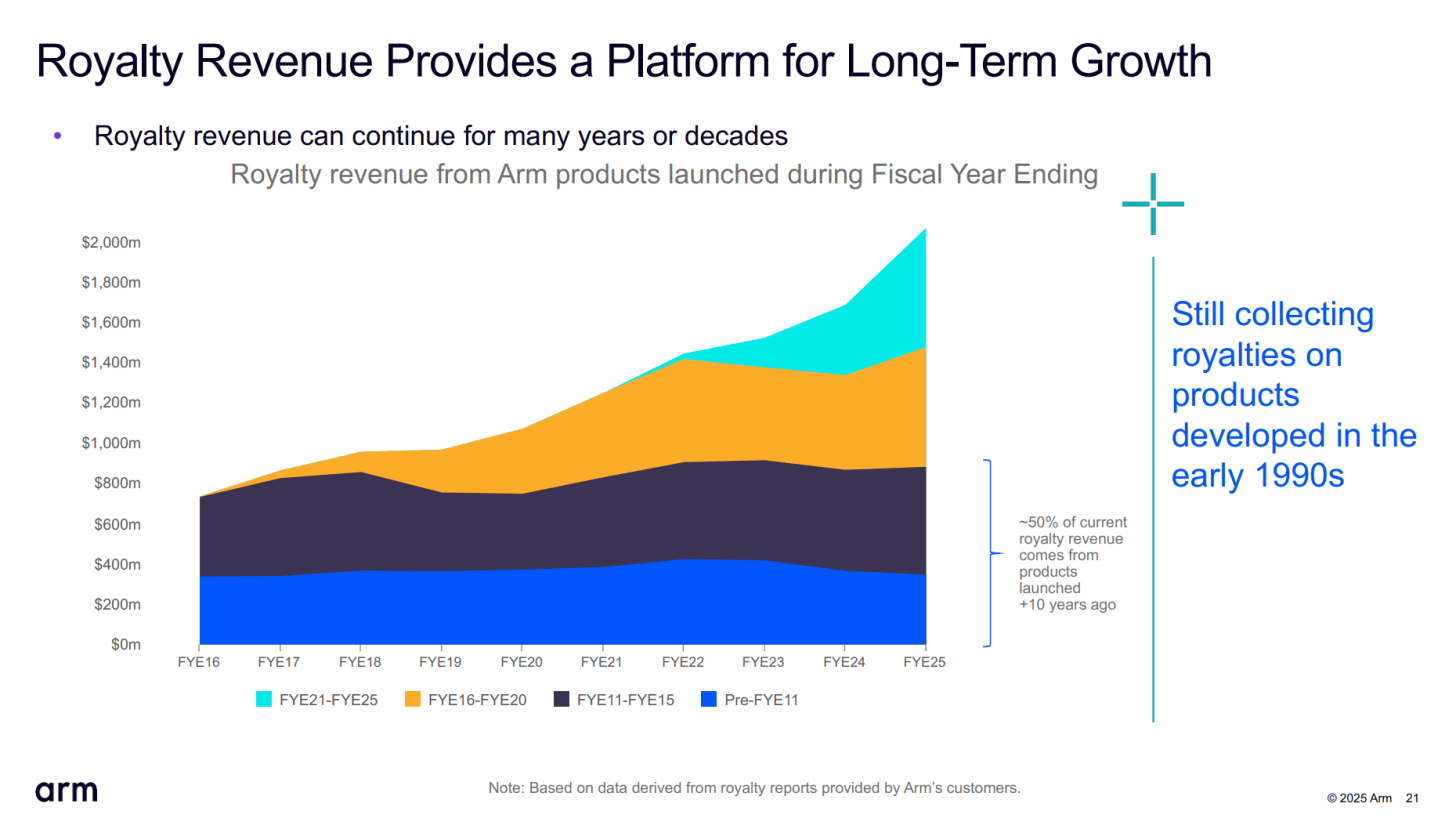

Arm’s second major revenue category – and in most quarters, the larger of the two – is Arm’s royalty revenue. Directly tied to the success of clients’ chips and the volumes shipped thereof, Arm’s business model thrives on royalties, especially as the long-term nature of these agreements means that Arm can still collect significant revenues for IP designs 10+ years old.

For the second quarter of Arm’s 2026 fiscal year, Arm recorded $620m in royalty revenues. This was up 21% from the year-ago quarter, when Arm booked $514m in revenue. In fact, this is a fresh record in royalty revenues for the company, surpassing even the atypically strong Q4’FY25 that still holds Arm’s total revenue record.

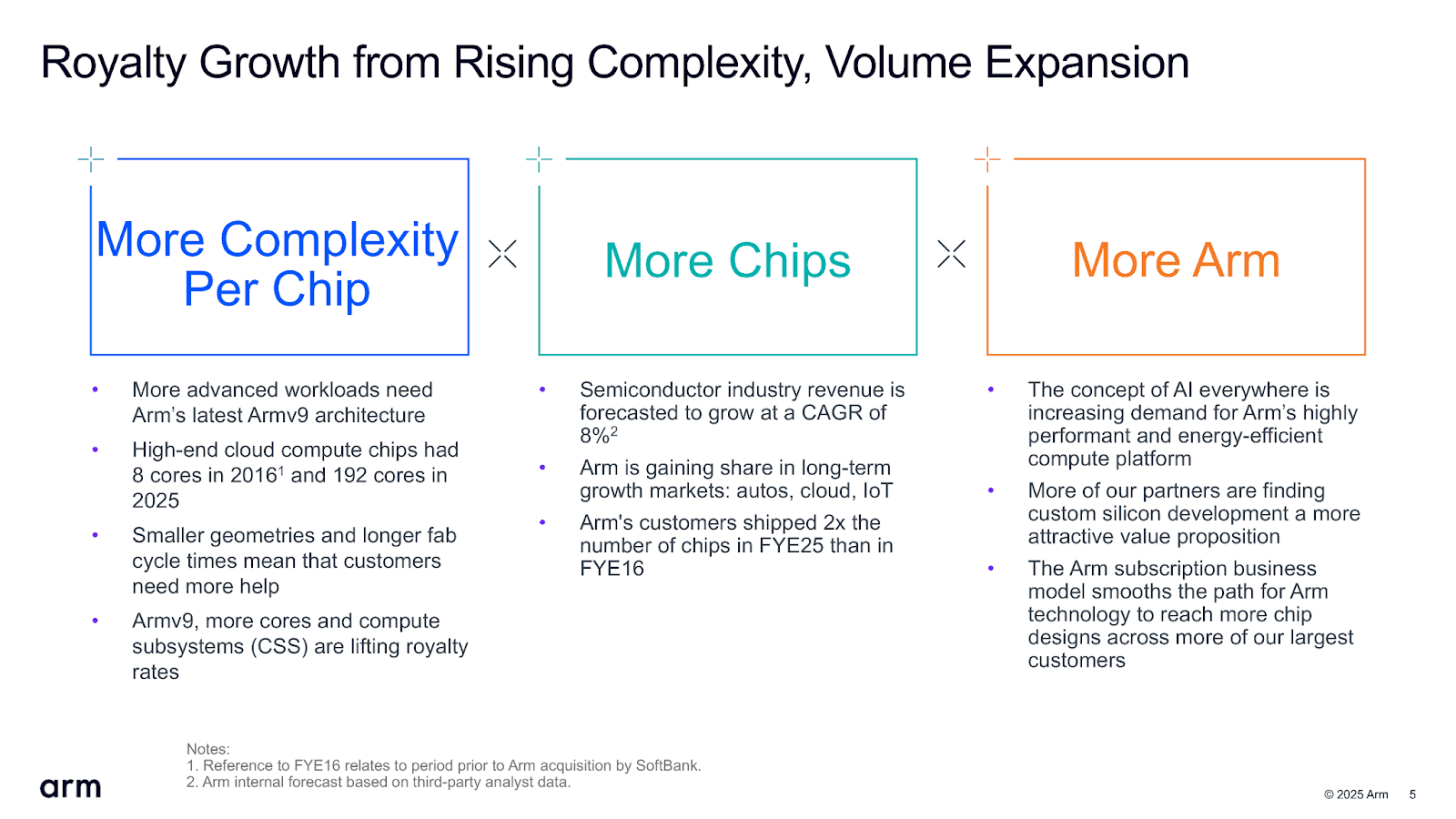

As has been the case for the last several quarters, Arm is attributing the bulk of the growth in royalty revenues to three major areas.

First has been the increased adoption of the Arm v9, which fetches higher royalties per unit than old architectures. Unfortunately, Arm hasn’t provided a fresh breakdown of royalties by architecture, so we do not have specific insight into just how much of Arm’s revenue is coming from the latest family of architectures. In lieu of that, in Arm’s Q4’25 earnings, which was the last time they offered this breakdown, Armv9 had just surpassed Armv7 (& older) architectures in revenue, at 31%. Though it still had a way to go to catch up to Armv8 revenue, which was at 44%.

The second major contributor to Arm’s royalty growth has been the sales of the company’s Compute Subsystems (CSS) – pre-assembled IP blocks that include not only Arm CPU cores but other bits of IP, allowing companies to skip that part of the integration process and bring products to market sooner. CSS designs feature more Arm IP, and in line with the additional work Arm does in assembling them, they fetch higher margins per chip than just licensing Arm’s CPU cores or other IP. As disclosed by Arm in its Q1’FY26 earnings, the royalty rates on its latest CSS v2 IP are over 10% of a chip’s ASP, the highest the Arm’s rates have ever been.

Finally, the third major contributor, as always, has been the continued growth of Arm CPU usage in the data center space. This goes for both general servers, and in AI systems. In the case of the latter, Arm doesn’t have a high-performance accelerator IP of its own; but because CPUs are still needed to drive AI-focused systems (e.g. Grace + Blackwell), AI system sales still drive the sale of Arm-based chips, all of which pays out as royalties for Arm. The company is especially pleased with the fact that these days it can count NVIDIA, AWS, Google, and Microsoft as major Neoverse customers for data center projects. And with the continued growth in deployment of Arm-based servers, Arm expects their share of CPUs deployed by top hyperscalers to reach nearly 50% this year.

Overall, Arm is citing Q2’FY26 as a success story for all of its target end markets. Royalty revenues were up across all markets, including not only smartphones and the data center, but automotive and IoT as well.

Outlook

Outlook is as follows:

💵 Q3’26 Revenue, $1.225b, +/- $50m

📈 Q3’26 EPS, $0.41, +/- $0.04

Rounding out Arm’s second earnings report for FY2026, we have their guidance for the third quarter of FY2026. As with the end of Q1, Arm is not providing any formal full-year guidance here; rather they are taking things one quarter at a time.

Coming off of a strong quarter for the company, Arm’s Q3 guidance calls for the company’s revenues to grow by a modest amount on a quarterly basis. With a forecast of $1.225b, +/- $50m, this would see Arm’s revenue grow by about 6% versus Q2. More significant would be the year-over-year gains, which if things go as forecast would represent a 25% jump in revenue.

Arm is also forecasting a quarterly increase in non-GAAP EPS – and by extension, net income. With guidance of $0.41 +/- $0.04, if this comes to pass it would be a $0.02 increase versus Q1. For that matter it would be an identical gain on a year-over-year basis, as Arm booked a non-GAAP EPS of $0.39 in Q3’FY25 as well.

Past this, the nature of Arm’s business as an IP provider – and a broad one, at that – means that there is no one product or IP release that is going to immediately and uniquely drive sales for the company in the next quarter. That means that Arm’s growth is going to be fueled by an amalgamation of many of the same factors that drove Q2 growth: data center chip royalties, expanding use of Arm CSS, and other higher royalty uses of Arm’s IP.

In the Analyst Q&A, there were a couple of key talking points brought up by a number of callers.

Arm’s Strategic Position within SoftBank’s Stargate Project

A number of analysts in the Q&A asked about Arm’s involvement in SoftBank’s Stargate initiative and the visibility that gives into the global AI infrastructure build-out. Management described Stargate as a multi-hundred-billion-dollar opportunity that spans compute, networking, power delivery, and system assembly, with Arm positioned as a key technology contributor. As both a SoftBank portfolio company and technology partner, Arm is helping define the compute architecture for these next-generation data centers, offering efficiency and scalability at a time when power and infrastructure constraints are emerging as industry bottlenecks. The company’s architecture is already being used by major partners such as NVIDIA and leading hyperscalers, reinforcing Arm’s role as a central component in the power-efficient compute fabric Stargate is aiming to deploy.

Arm’s Integration Across the Wider SoftBank Ecosystem

Analysts also pressed for clarity on how far SoftBank’s downstream companies could extend Arm technology beyond Stargate itself. Management noted that SoftBank’s related entities are engaging with Arm across multiple fronts – design services, licensing, and funded R&D – and that’s creating a layered commercial model. The arrangement goes beyond simple related-party revenue: it allows Arm’s IP to be embedded across SoftBank’s wider network in data center, telecom, and AI applications, with the potential for recurring royalties as those products reach volume. Arm framed this as a durable, multi-year opportunity that aligns with SoftBank’s broader strategy to anchor compute, connectivity, and efficiency across its portfolio.

More Than Moore, as with other research and analyst firms, provides or has provided paid research, analysis, advising, or consulting to many high-tech companies in the industry, which may include advertising on the More Than Moore newsletter or TechTechPotato YouTube channel and related social media. The companies that fall under this banner include AMD, Applied Materials, Armari, ASM, Ayar Labs, Baidu, Dialectica, Facebook, GLG, Guidepoint, IBM, Impala, Infineon, Intel, Kuehne+Nagel, Lattice Semi, Linode, MediaTek, Next Silicon, NordPass, NVIDIA, ProteanTecs, Qualcomm, SiFive, SIG, SiTime, Supermicro, Synopsys, Tenstorrent, Third Bridge, TSMC, Untether AI, Ventana Micro.

Below the fold is for paid subscribers only.

You could probably get these transcripts elsewhere, but that’s not here, is it? 🙂