will be holding its 2026 Financial Analyst Day on November 11th, 1pm ET, and will be streamed online. This is its first public FAD since 2022.

AMD once again finds itself in an enviable and enriching position in the tech industry. The chip designer has become increasingly disciplined and successful in growing its core markets over the past couple of years, projecting an image of competency and consistency to customers as it works further to build out its product lineups. As a result, the company is once again reporting record revenues across most of its businesses, with top-line revenue and multiple product segments all seeing substantial year-over-year growth.

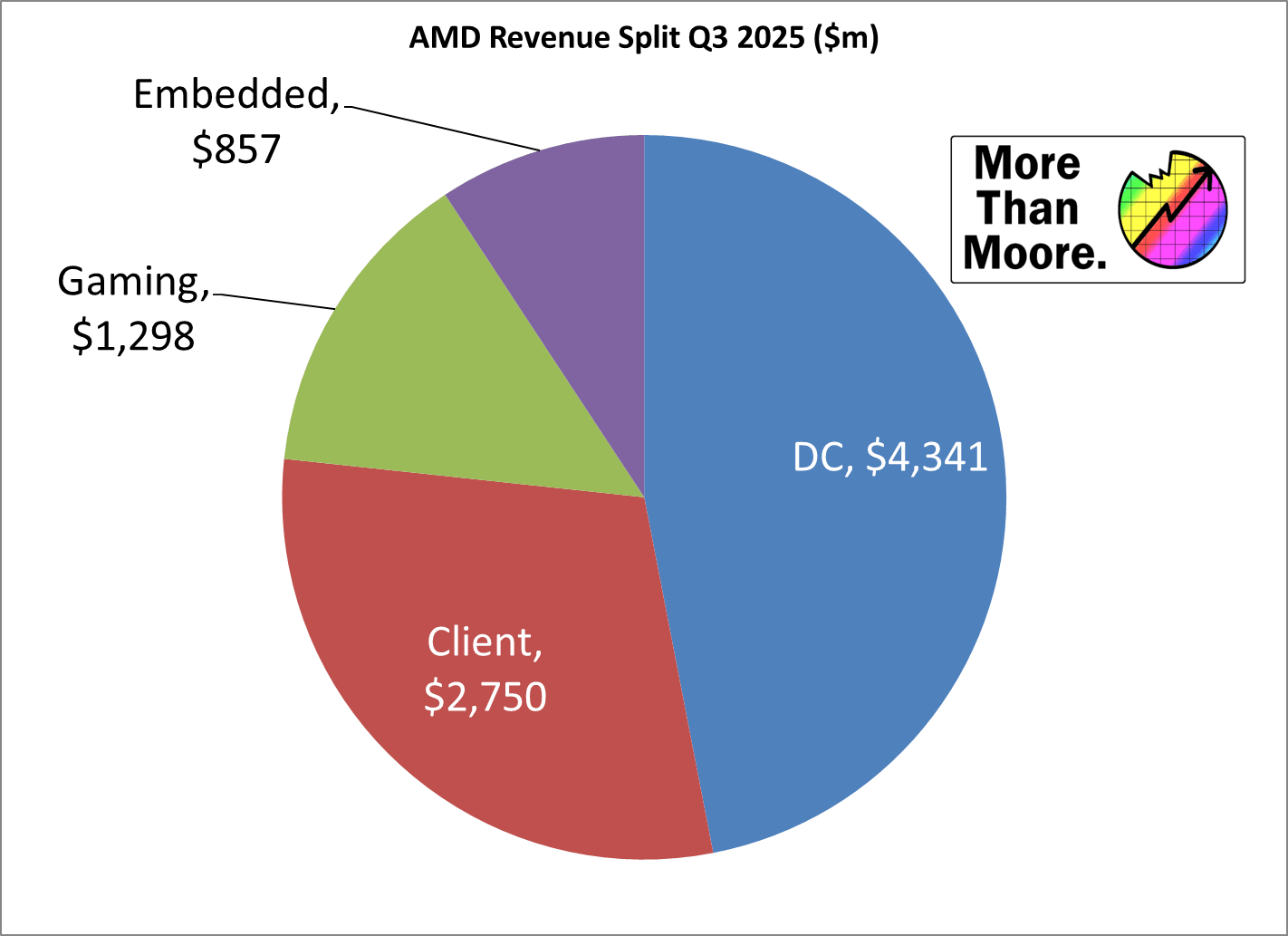

With strong offerings in both the GPU and CPU spaces, for the most recent quarter AMD has been able to maintain a fairly diversified revenue stream. While the headline product for the company has been its latest generation data center GPU, the Instinct MI350 series which which has allowed AMD to tap into the seemingly insatiable demand for GPUs for AI inference and training, the company has also reported strong sales in data center CPUs and multiple flavors of client products. In short, everything seems to be going AMD’s way for the most recent quarter.

Coming off of Q2’2025, AMD has also been able to cast off the anchor of the Instinct MI308, AMD’s export-grade GPU that was meant for China before getting caught up in a new round of export restrictions. While AMD’s MI308 inventory still remains in limbo – the company is very quick to point out that they still haven’t sold any of it – the end of inventory charges has removed a significant weight from AMD’s earnings.

Key Takeaways (GAAP)

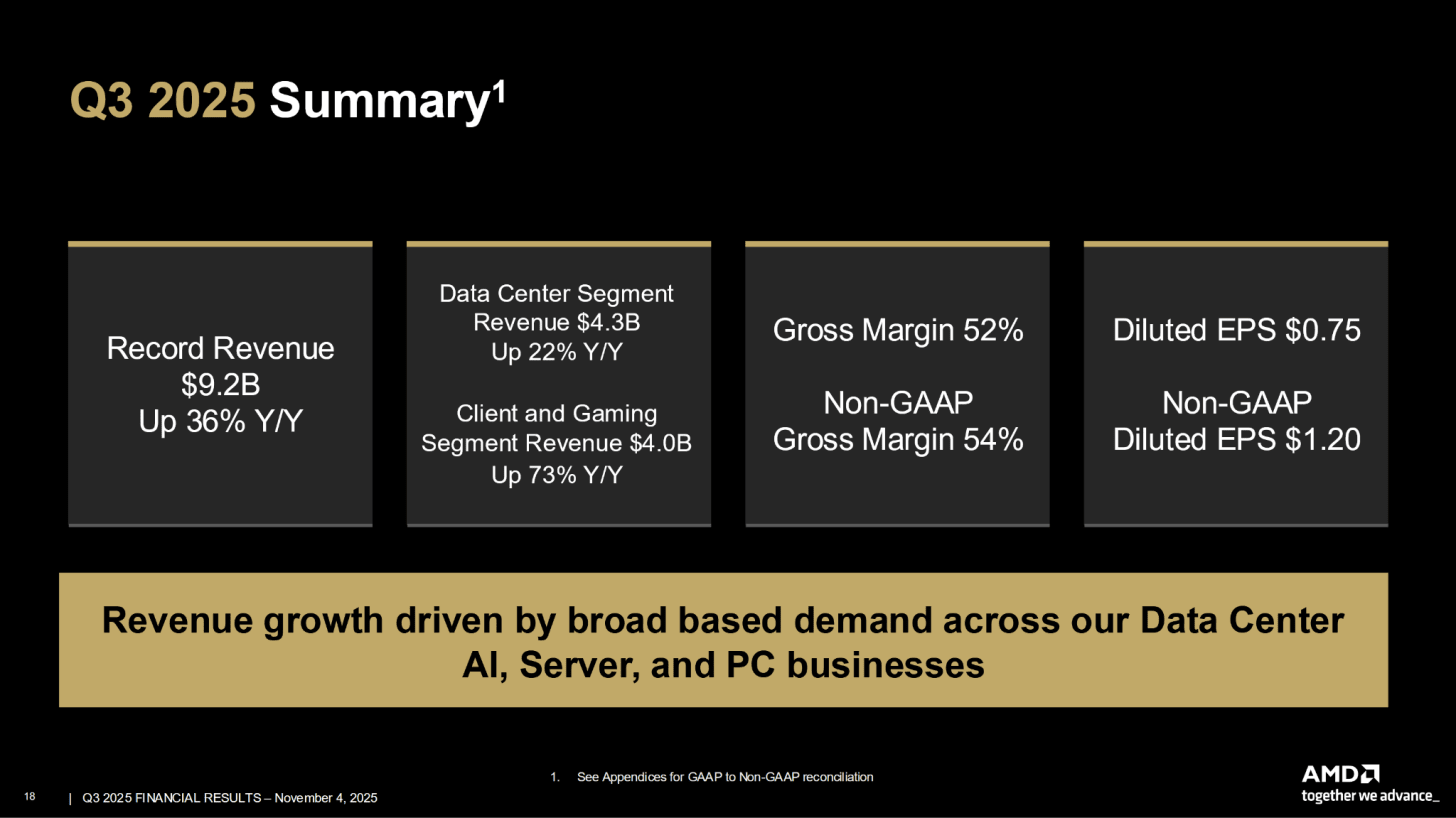

💵 Q3 Revenue, $9.25b, up 36% YoY from $7.69b and up 20% QoQ

📈 Q3 Gross Margin at 52%, up 2pp YoY and up 12pp QoQ

💰 Q3 Net Income of $1.24b, up 61% YoY from $771m and up 43% QoQ

🪙 Q3 EPS $0.75, up 60% YoY, up 39% QoQ

Key Takeaways (Non-GAAP)

💵 Q3 Revenue, $9.25b, up 36% YoY from $7.69b and up 20% QoQ

📈 Q3 Gross Margin at 54%, flat YoY and up 11pp QoQ

💰 Q3 Net Income of $1.97b, up 31% YoY from $1.5b and up 152% QoQ

🪙 Q3 EPS $1.20, up 30% YoY, up 150% QoQ

Highlights

With AMD’s increasing success across both the client and data center markets, the company has overseen several notable developments over the past 3 months. While there has been no significant movement in terms of new products – AMD is now decidedly mid-generation on most of its product lines – the sales side of the company has seen several major wins:

-

AMD won two new supercomputer contracts for Oak Ridge National Laboratory. A smaller AI system, the EPYC Turin + Instinct MI355X-based Lux, will be installed in 2026. Meanwhile in 2028, ORNL will be installing a new flagship supercomputer to supplant the current AMD-based Frontier system. The replacement system, dubbed Discovery, will be built around AMD’s EPYC “Venice” CPUs and Instinct MI430X accelerators. The total price tag on the two systems will be $1 billion, according to AMD

-

AMD has completed the divestiture of ZT Systems’ data center infrastructure manufacturing business to Sanmina. Having acquired ZT Systems for its design teams and know-how, AMD opted not to retain ZT’s actual manufacturing operations. With this sale, AMD’s acquisition of ZT is now effectively complete. Sanmina also becomes a minority stakeholder in AMD.

Financial Overview

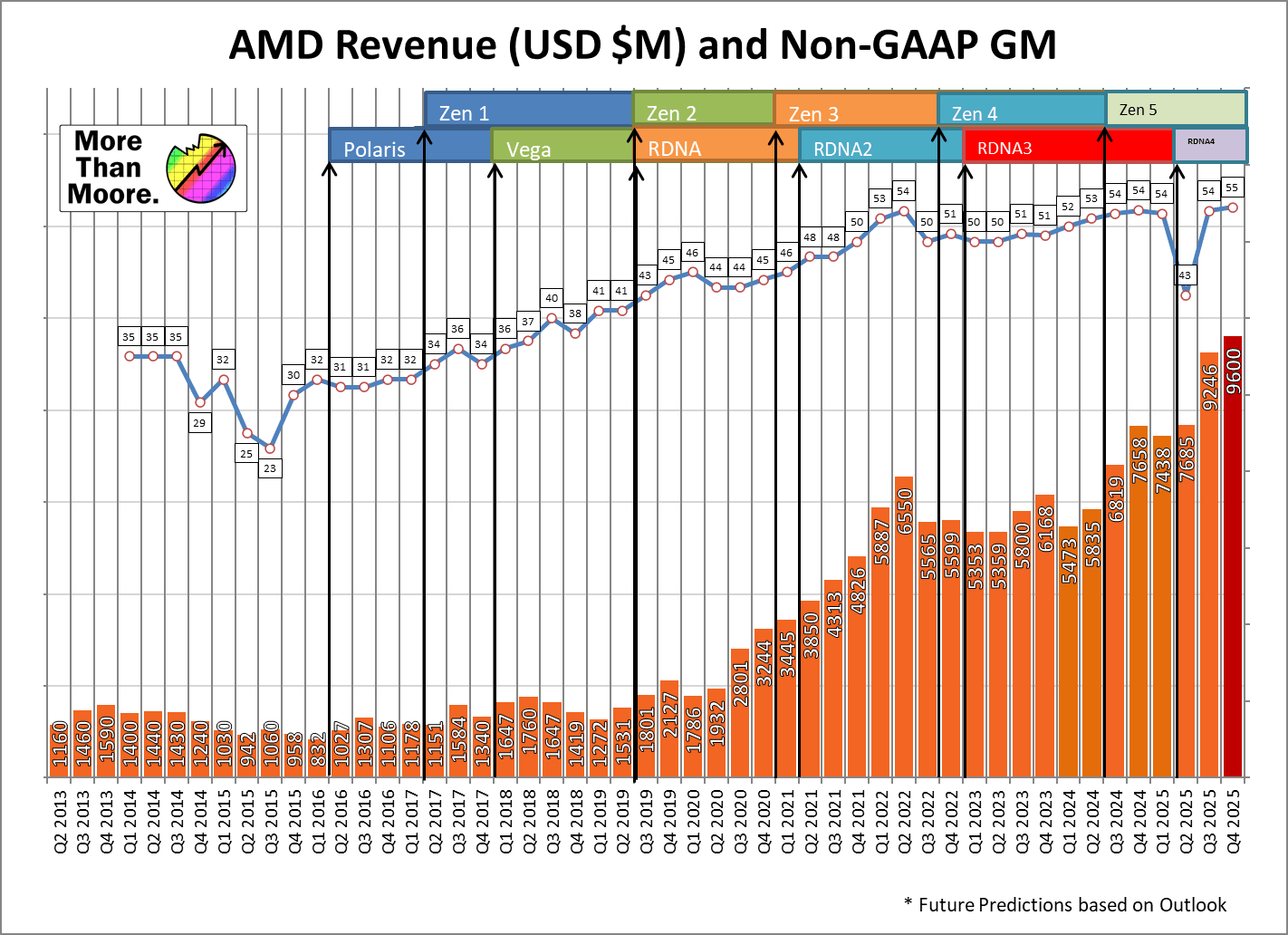

Diving into the numbers, Q3’2025 is going into the books as yet another record quarter for AMD. In terms of revenue, AMD has once again set a quarterly record, with $9.25b in revenue easily eclipsing the old record of $7.69b, set just last quarter. Overall, AMD’s revenue for the quarter is up 36% on a year-over-year basis, and even compared to the most recent quarter it’s up 20%.

With Q3 in particular, part of this revenue growth is attributable to seasonality, especially on the client side of matters as OEMs and stores stock up on hardware ahead of the holiday shopping season. But AMD is also seeing strong growth in the more steadfast Data Center business unit, thanks to the one-two-three punch of EPYC “Turin” CPUs, EPYC “Genoa” CPUs, and Instinct MI accelerators.

And with AMD seemingly firing on all cylinders here, their gross margins are looking strong as well. With Q2 and its inventory write-downs behind them, AMD’s GAAP gross margin has recovered to 52%, 12pp better than Q2 and still up 2pp year-over-year. Even when looking at non-GAAP figures, the story is pretty similar, with AMD’s 54% non-GAAP gross margins essentially flat on the year.

As a result, AMD’s profitability is also through the roof. For Q3 AMD booked $1.24b in net income on a GAAP basis, which is a 61% pop over the year-ago quarter. Surprisingly, this isn’t a record for AMD (that was set in Q4’20), but it is their second-best net income in the history of the company – and arguably the best “normal” quarter the company has ever seen.

Digging below the top line, we find a couple of interesting nuggets of information about AMD’s spending. AMD has significantly ramped up its research and development spending over the past year; whereas Q3’2024 was at $1.6b, Q3’2025 has seen R&D spending grow by 31% to $2.1b. With AMD’s revenue and profitability on a rapid rise, the company is in a position to easily eat those costs, investing into future generations of products to hopefully sustain this level of growth.

Otherwise, AMD’s GAAP balance sheets continue to reflect multiple multi-million-dollar charges to the company. Notably AMD is once again taking amortization charges for acquisition-related intangibles (i.e. Xilinx) – this time for $562m – as well as a greater-than-usual $419m charge for stock-based compensation. All told, AMD’s “all other” category that records these charges took an operating loss of $954m for the quarter, continuing the company’s streak of losing around a billion dollars a quarter in this category. Thankfully for AMD, their continued prodigious growth is more than offsetting these changes – and making them a relatively smaller problem overall – and the total loss for the All Other category has dropped slightly on both a quarterly and yearly basis.

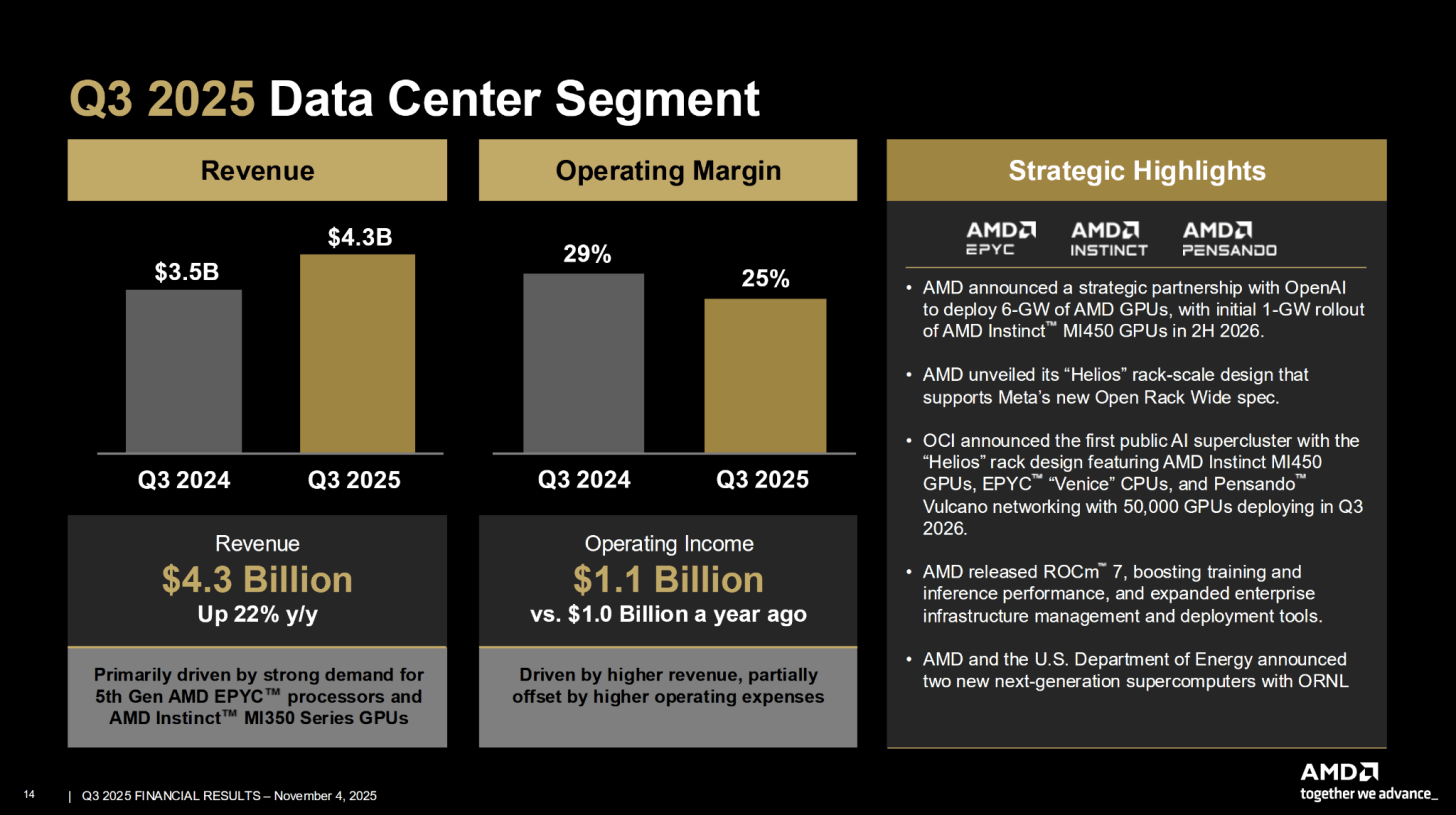

Data Center: EPYC, Instinct

💵 Q3 Revenue $4.34b, up 22% YoY

💰 Q3 Operating Income $1.08b, up 3% YoY from $1.04b

📈 Q3 Operating Margin 25%, down from 29% YoY

For their most recent quarter, AMD’s Data Center business unit has returned to being AMD’s most profitable business unit. With both strong revenue growth and relatively high margins, by every metric Data Center is once again AMD’s best performing business unit.

By the numbers, AMD booked $4.34b in revenue under its data center group for Q3’25, which was up 22% YoY. And without MI308 weighing things down this quarter, the unit’s operating income has quickly rebounded, hitting $1.1b for the quarter, up 3% YoY.

Looking at AMD’s figures and slides, it’s hard to miss the disparity between Data Center revenue growth and operating income growth, however. While AMD has been able to significantly expand revenues, operating income is only slightly better than flat. In short, AMD is selling much more data center hardware compared to Q3’2024, but they’re not making much more in the way of profits in doing so. As a result, the segment’s operating margins are down accordingly, dropping from 29% to 25% over the last year. According to AMD, this is due to a combination of higher operating expenses as well as higher R&D investments.

As for Data Center revenue in general, while AMD doesn’t provide a detailed breakout of EPYC (CPU) versus Instinct (GPU) sales, in their high-level comments AMD is attributing the bulk of their YoY revenue growth to both segments. According to the company, they’re seeing strong demand for both their 5th generation EPYC “Turin” processors, as well as the recently launched MI350 accelerators. In previous quarters this growth has been more commonly attributed to just the CPU side of the business, so it looks like GPU sales are significantly growing again.

For the next couple of quarters, we will likely see the MI350 be the centerpiece of data center gains, as AMD continues the long, multi-quarter ramp up of that product. EPYC Turin is also continuing its slow ramp, though at a few quarters older than MI350 it’s had far more time overall. Despite all of this, Turin sales still haven’t crossed the 50% mark for EPYC revenue – AMD reports that Turin sales in Q3 was just under half of all EPYC revenue – so there is still some room for Turin sales to grow as customers phase out of buying older EPYC products.

And while all of that is going on, AMD is already preparing their 6th generation EPYC “Venice” processors for their 2026 launch. AMD’s next-generation 2nm flagship server CPU is in the company’s bring-up lab, and is “performing very well” according to the company. Consequently, on the business side of matters, AMD is reporting that engagement for Venice is the strongest they’ve ever seen for an in-development EPYC part, with multiple cloud/OEM partners having Venice platforms up and running.

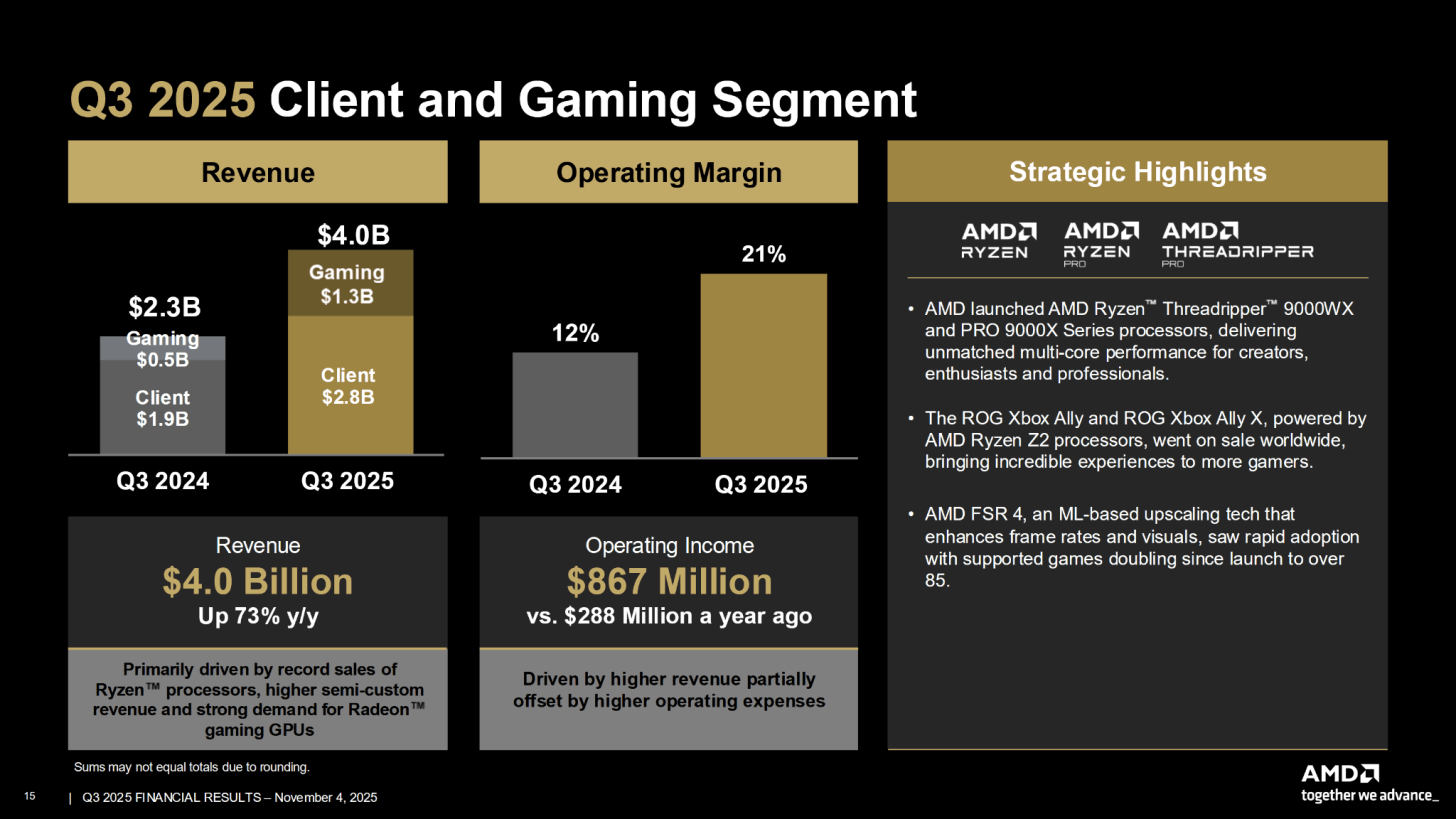

Client and Gaming: Ryzen, Radeon

💵 Q3 Revenue $4.05b, up 73% YoY

💰 Q3 Operating Income $867m, up from $288m YoY

📈 Q3 Operating Margin 21%, up from 12% YoY

AMD’s other big success story for Q3’25 has been their Client and Gaming segment. The core of AMD’s classic business operations, the last year has seen this segment thrive thanks to AMD’s Zen 5 CPU architecture as well as their latest RDNA 4 GPU architecture. After a brief blip last quarter as AMD’s largest business unit, Client and Gaming has settled back in at the number 2 spot – though it’s still a large part of AMD’s overall success.

For Q3’25, AMD booked $4.05b in Client and Gaming revenue, a ridiculous 73% year-over-year increase for the segment. This revenue growth was driven by all parts of the business unit, with client CPU sales, client GPU sales, and semi-custom (console SoC) sales all growing on a year-over-year basis. All told, client sales made up $2.8b of AMD’s revenue for the quarter, followed by $1.3b for client GPU and semi-custom console SoCs.

As a result, the profitability of the segment has also greatly improved on a year-over-year basis. The $867m in operating income is several times higher than Q3’24’s operating income, and this is reflected in the segment’s operating margin as well, which hit 21% for the quarter, tying Q2’25’s margins.

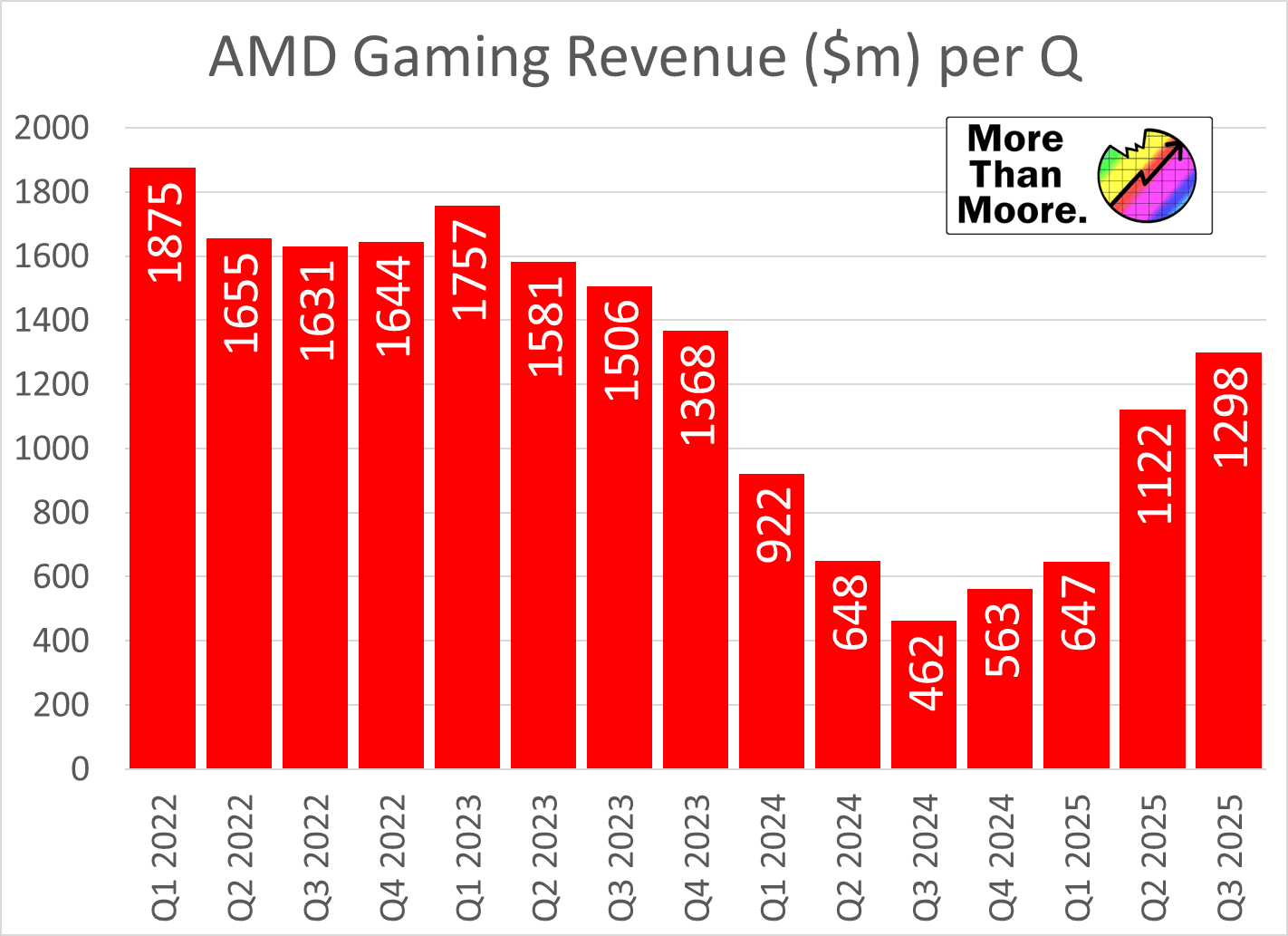

Overall, the $4.05b in revenue was a new all-time record for this segment. Though splitting it up between its individual Client and Gaming components, it quickly becomes clear that the real record is on the Client side of the business, with AMD surpassing last quarter’s client record by nearly $250m. Otherwise, while AMD’s Gaming segment has recovered nicely from its lows last year, Gaming revenue as a whole is still quite a way behind the records set in 2022.

Driving these revenue gains has been a confluence of factors. The most regular has been the annual seasonal holiday stock-up, which leads to Q3 being a strong quarter for AMD most years. AMD says they sold a record number of Ryzen processors this quarter (though it’s unclear if this is a Q3 record or all-time record), with AMD reporting that Ryzen PC sell-through rate is up more than 30% year-over-year. Interestingly, they’re ascribing that increase primarily to enterprise sales, particularly with large wins with Fortune 500 companies. Given the timing – as well as rival Intel’s own CPU sales reports – it sounds like AMD is the beneficiary of consumers and businesses alike buying new systems to replace aging out Windows 10 machines.

As for gaming, AMD’s semi-custom business is enjoying a seasonal rebound in product demand. Console chip sales in particular have been a laggard over the last several quarters as console makers worked their way through a large stockpile of chips, and they are now finally replenishing those stocks ahead of the holidays. The most recent quarter also saw the launch of some new handhelds based on Ryzen Z-series chips, though it doesn’t sound like those are having nearly the same impact as traditional console SoC sales.

Finally, AMD is reporting that demand for Radeon video cards is also high. Though the company isn’t outlining any figures on sales numbers or revenue. AMD has not launched any new GPUs (or SKUs) in the most recent quarter, but ramped what it has launched, so any major shifts in demand on a quarterly basis are likely seasonal as well. Otherwise on a yearly basis, AMD was in the process of winding down Radeon RX 7000 series sales in the year-ago quarter, so Q3’25 should have easily outperformed the Q3’24 in that respect.

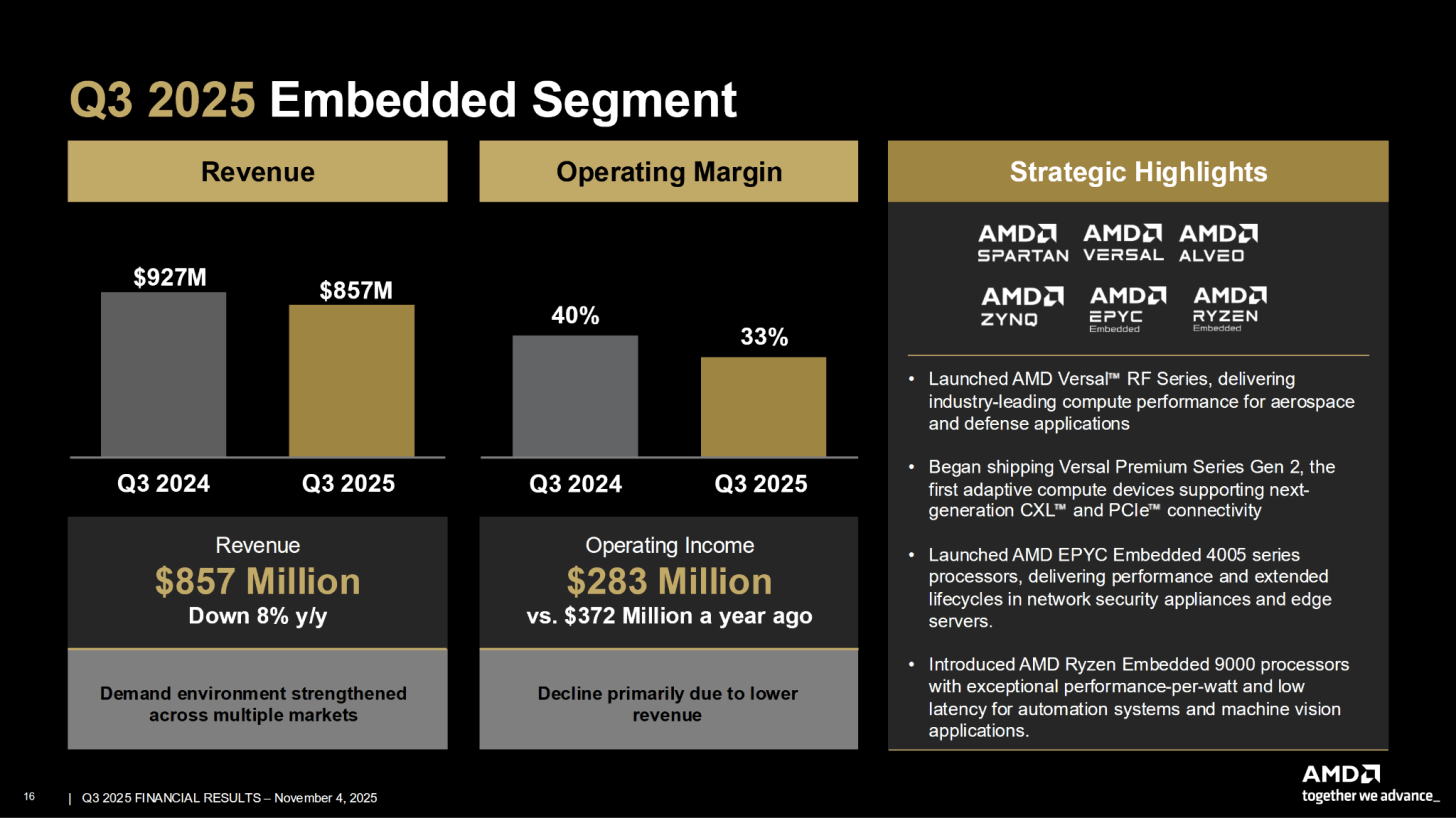

Embedded: Xilinx, AMD Embedded

💵 Q3 Revenue $857m, down 8% YoY

💰 Q3 Operating Income $283m, down from $372m YoY

📈 Q3 Operating Margin 33%, down from 40% YoY

Covering AMD’s Xilinx products as well as embedded versions of their CPUs/APUs, the embedded unit has faced its own headwinds over the last several quarters, still stemming from the delayed reaction that this segment has had to the pandemic. This has resulted in a business unit that’s been in decline for the last two years. While AMD turned the corner of sorts back in Q4, the recovery here continues to be pretty slow, despite AMD mentioning that some of the market verticals in this segment are returning to normal. Other FPGA businesses have had similar environments, and some of those are slowly coming out of their nadir.

For the most recent quarter, AMD booked $857m in embedded revenue, which was down 8% year-over-year, but up slightly sequentially. Similarly, AMD’s operating income has dropped over the past year, sliding even harder from $372m to $283m. Nonetheless, with an operating margin of 33%, the embedded segment remains AMD’s single highest margin segment. As a result, even when it’s down, it’s still reasonably profitable – and consistently so.

For their latest quarter, AMD has once again said relatively little about the embedded segment. While it’s a very consistent business unit in terms of revenue, the segment’s profitability has been on a downward slide. AMD says that demand has strengthened across multiple markets, but that hasn’t stopped the year-over-year slide in revenue. The silver lining, at least, is that things have picked up on a quarterly basis; after the past two quarters of recent lows for the business unit, getting revenues about $850m again is a meaningful improvement in revenue, with a slight bump in operating incomes coming with it.

AMD launched several new products under the Embedded umbrella over the most recent quarter, including new Ryzen and EPYC embedded processors, as well as new adaptive SoCs. Though it is going to take some time for those products to have a significant impact on the business unit’s bottom line.

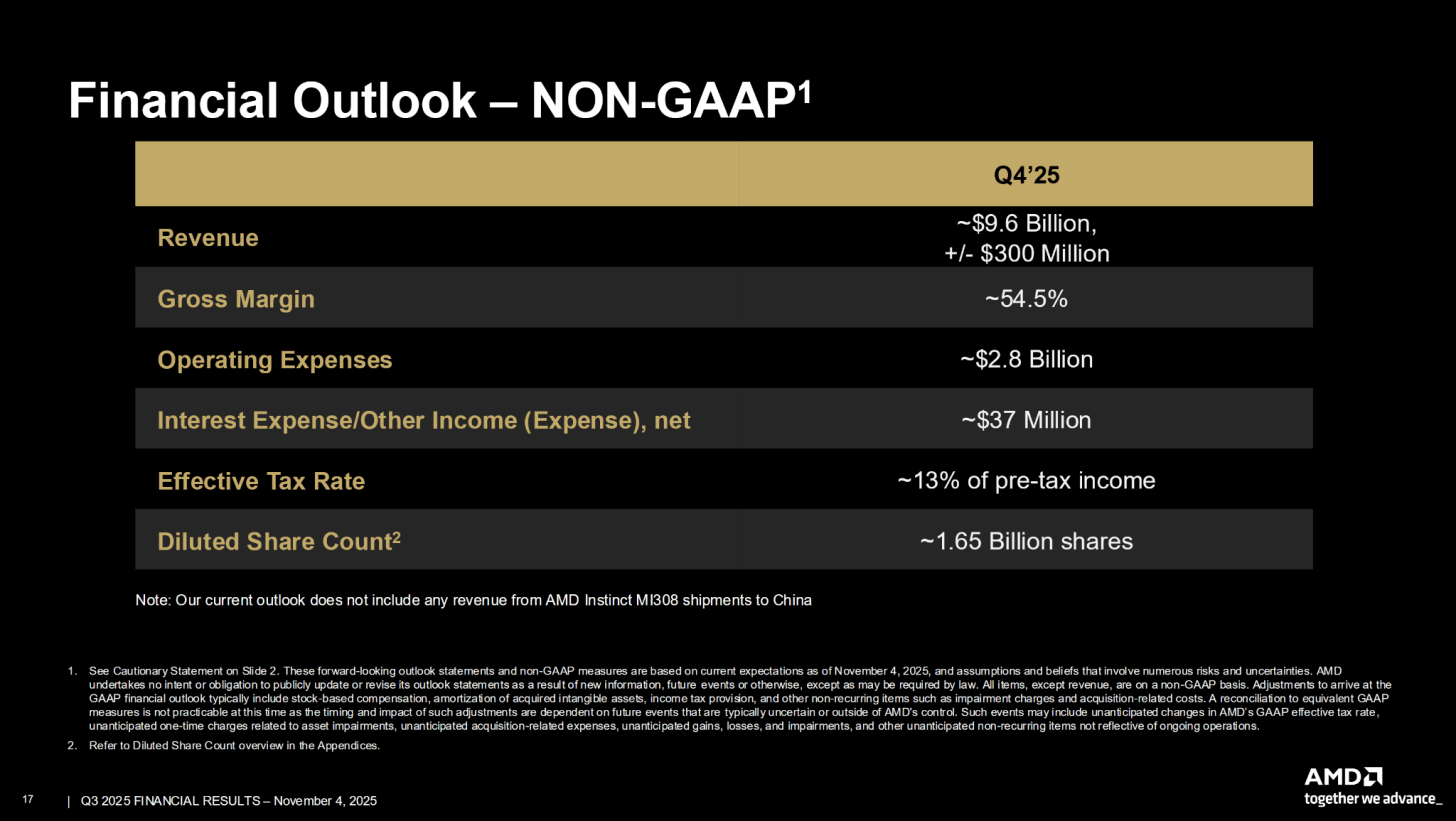

Outlook

Outlook is as follows:

💵 Q4’25 Revenue, $9.6b, +/- $300m

📈 Q4’25 Gross Margins of 54.5% (non-GAAP)

For the final quarter of 2025, AMD is once again expecting a very strong quarter for the company. $9.6b in revenue for Q4 would represent around 25% YoY revenue growth for the company, and would yet again set records for both Q4 revenue and all-time revenue.

Meanwhile AMD’s non-GAAP gross margin estimate of 54.5% would represent the slightest of upticks from Q3’s 54% margins, meaning that AMD is largely expecting margins to hold flat versus increased revenue, which should be good news for AMD’s earnings per share.

In comments during their earnings call, AMD outlined that besides the seemingly unbreakable growth of the Data Center segment thanks to continued Turin and Instinct MI350 ramping, they’re also expecting Client and even Embedded sales to be up for the quarter.

The one predicted laggard will be Gaming, which AMD is expecting to see double-digit declines in revenue. AMD didn’t provide any further color there, but with demand for console SoCs spiking in the quarter before the holiday, presumably demand is dropping back off in Q4.

Overall AMD highlighted that they recognize that their revenue estimates for Q4 are above market expectations – several hundred million dollars higher. This seems to be on the back of that strong server CPU demand as well as the rest of the data center business.

AMD reiterated that its Financial Analyst Day 2025 will be occurring on November 11th, 1pm ET, and will be streamed online.

Takeaways from Analyst Q&A

The questions from the analysts fit into a few key buckets, although primarily looking at how customer centric AMD will be to OpenAI, as well as some of the (perhaps) unexpected growth in the CPU business compared to the AI business.

CPU Momentum Adds Stability to the AI Cycle

While GPUs dominate the AI narrative, AMD is seeing broad-based strength in traditional server CPUs. The Turin ramp has been described as rapid and well aligned with customer demand, coming in at just under half of the data center CPU revenue, while Genoa continues to perform strongly as many hyperscalers maintain mixed deployments. AMD noted that several large customers are planning robust CPU buildouts in 2026 to complement their AI clusters, both in Turin (Zen 5) and in future Venice (Zen 6), suggesting that traditional compute is benefiting from the same AI-driven expansion cycle as more AI work generates more CPU work. The company anticipates continued positive growth and didn’t really comment on whether seasonality was expected, describing CPU demand as durable and multi-quarter rather than a short-lived spike.

Data Center Strength Broadens Beyond GPUs

AMD highlighted strong sequential and year-on-year data center performance in Q3, driven by steady demand from hyperscalers and enterprise customers. The MI355 GPU has been ramping as planned, and will remain a key contributor through the first half of 2026, followed by the MI450 in the second half. Even without MI308 sales, the segment outperformed expectations. Customers are providing forward visibility into sustained elevated demand, and AMD expects double-digit sequential gains across both server and AI segments heading into Q4. The broader takeaway is that AMD’s data center growth is now being supported by multiple engines – in this case CPU refresh cycles, GPU acceleration, and system-level adoption.

OpenAI Becomes a ‘Unique’ Structural Anchor Partner

AMD’s collaboration with OpenAI has emerged as a substantial piece of its long-term AI strategy. Through the answers, it was reaffirmed the relationship extends across hardware, software, and full rack-scale system deployment through the Helios platform. As announced, the first gigawatt-scale installations are planned for the second half of 2026, with supply and power infrastructure already being coordinated between AMD, OpenAI, and cloud partners. AMD described the partnership as unique in both cost structure and scale, designed with aligned incentives for both parties and long-term mutual benefit, and seemingly unlikely to be replicated. While OpenAI will clearly represent a substantial portion of data center GPU demand, AMD emphasized that it is balancing concentration risk by building similar multi-year engagements with other hyperscalers and sovereign AI programs, with AMD saying that these are also ‘unique’ engagements.

Helios and MI450 Rack-Scale

The Helios rack-scale platform is now at the center of AMD’s data center roadmap, designed to deliver full-system compute at scale rather than focusing solely on discrete accelerators. Feedback at the Open Compute Project (OCP) event was described as overwhelmingly positive, with strong interest from hyperscalers and system integrators. MI450, which powers Helios, is being positioned as a balanced solution for both training and inference, offering competitive performance, memory bandwidth, and efficiency metrics. AMD expects early customers to adopt Helios at the rack level, with other form factors following later. The company also acknowledged that tightness in power, interconnect, and memory supply chains will persist, but expressed confidence in its ability to deliver on 2026–2027 deployment schedules as additional capacity comes online due to extensive investments made over previous quarters.

ROCm 7 and Software Maturity

On the software side, ROCm 7 was launched in September, and marks a major step forward in performance, framework compatibility, and developer experience. AMD reported that most customers now have a smooth onboarding path for bringing workloads to ROCm-based systems, aided by native framework support, day zero models, and continually improved libraries. The company is investing further in reinforcement learning, inference optimization, and system integration to maintain momentum. Collaboration with OpenAI has directly benefited the software stack, particularly through co-development on the Triton framework, which AMD sees as critical for long-term developer adoption. The emphasis is now on building out ROCm’s breadth, using both large customer contributions and AI-assisted internal tooling to accelerate development cycles.

AI Market To The Moon

AMD reiterated that the total addressable market for AI compute silicon will surpassed its previous $500 billion projection and continues to rise. The company views this as an opportunity for both product and platform expansion, not just incremental chip sales. MI450’s role as a unified training and inference engine, paired with AMD’s system-level designs, is being emphasised as the platform for hyperscalers seeking flexibility beyond proprietary solutions, and that $500b+ goes beyond to future generations as well.

Regional and Policy Dynamics Remain Fluid

AMD acknowledged that the situation in China remains uncertain. MI308 shipments are subject to licensing restrictions, with some approvals obtained, but insufficient visibility to include in official guidance. The company continues to refine product variants for that market but will assess demand and policy changes before committing to large-scale production. Management framed this as a variable rather than a strategic dependency, and will address it proportionally when the opportunity arises.

More Than Moore, as with other research and analyst firms, provides or has provided paid research, analysis, advising, or consulting to many high-tech companies in the industry, which may include advertising on the More Than Moore newsletter or TechTechPotato YouTube channel and related social media. The companies that fall under this banner include AMD, Applied Materials, Armari, ASM, Ayar Labs, Baidu, Dialectica, Facebook, GLG, Guidepoint, IBM, Impala, Infineon, Intel, Kuehne+Nagel, Lattice Semi, Linode, MediaTek, Next Silicon, NordPass, NVIDIA, ProteanTecs, Qualcomm, SiFive, SIG, SiTime, Supermicro, Synopsys, Tenstorrent, Third Bridge, TSMC, Untether AI, Ventana Micro.

Below the fold is for paid subscribers only.

You could probably get these transcripts elsewhere, but that’s not here, is it? 🙂