The worryingly emaciated 800lb gorilla of the CPU industry went through a very turbulent 2024 that saw it take some heavy losses as the company attempted to right its course amidst significant competition in both the chip design and chip fab markets. Coming into 2025, has been taking steps to address its systemic issues and slim down the company, initiatives being spearheaded by newly hired CEO Lip-Bu Tan, but Intel will still need several quarters to pull off the turnaround its seeking. Which means that as far as Intel’s financials go, there’s still some correction on the books.

Intel’s new CEO joined the company in March. Lip-Bu Tan is best known for his 12-year tenure as CEO of close Intel partner Cadence, the EDA company, whose software is used to build processors. The general consensus is that he is coming in, with the board’s approval, with a vision of slimming Intel down even further and adopting a more startup mindset. Tan has a lot of work ahead of him. After a reasonably well received keynote at Intel Vision only two weeks into the job, and he’s already started on that task: along with the earnings release, Tan penned a memo to company employees (and released to the public) underscoring his desire to cut back on costly capital expenditures and flatten Intel’s organization and remove management. Ultimately we expect this to include yet-to-be-determined layoffs at some future point to align with that narrative. Also in the memo is a required return to office mandate, that will see Intel hybrid employees in the office 4 days a week (up from the current 3). Tan believes that in-office collaboration will be part of the solution needed to bring a leaner and meaner Intel back to profitability.

In the meantime, amidst the harsh realities of additional cuts and another quarter well into the red for the company, Intel has been able to find some silver linings by eking out some small wins. Most notably, the company is coming in ahead of its Q1 revenue and gross margin guidance – still losing money, but less so – which is a much-needed sign from the company that they’re starting to turn things around. From a holistic standpoint, Intel is still far from where they want to (or need to) be, but the general consensus is that the direction is good.

Key Takeaways (GAAP)

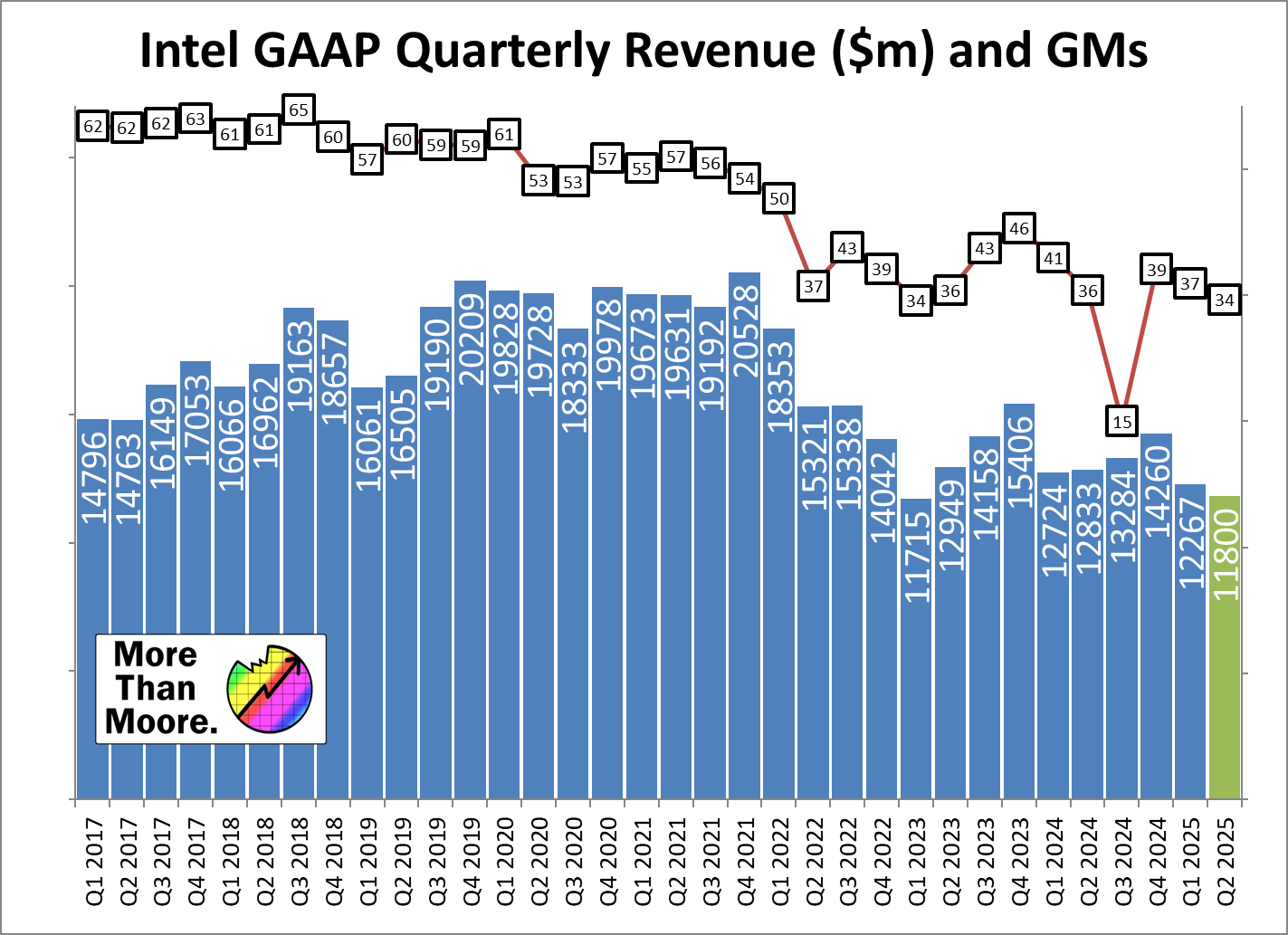

💵 Q1 Revenue, $12.7b, flat YoY from $12.7b and down 11% QoQ

📈 Q1 Gross Margin at 36.9%, down 4.1pp YoY and down 2.3pp QoQ

💰 Q1 Net Income of -$887m, down 115% YoY from -$437 and down 604% QoQ

🪙 Q1 EPS -$0.19, down 111% YoY, down 533% QoQ

Highlights

While Intel isn’t making any major product development disclosures alongside the earnings announcement, there are a few important business milestones that bear mentioning.

-

Intel has finished divesting itself of its NAND business. The final phase of the sell-off to SK hynix was completed in March, which also involved around 4000 employees now being filed as non-Intel employees.

-

Intel is also in the process of divesting a majority stake of FPGA-maker Altera to private equity firm Silver Lake. Intel will retain a minority stake, 49% of the company. The sale values Altera at $8.75 billion.

-

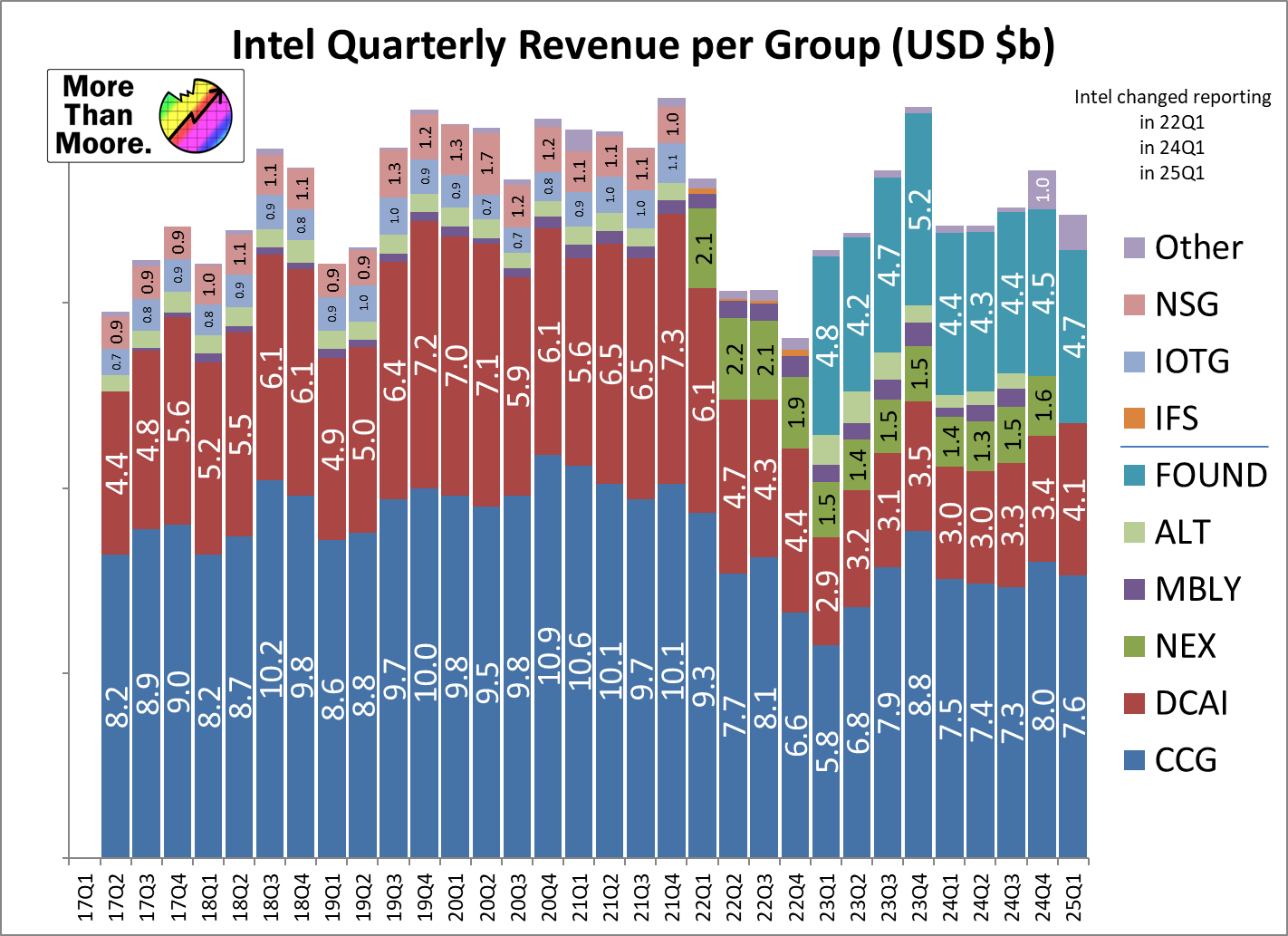

Intel’s dissolution of its Networking and Edge Group (NEX) is complete. As revealed during its Q4 earnings, the Edge business has been rolled into the client business (CCG), and the networking business is now part of the data center business (DCAI).

Financial Overview

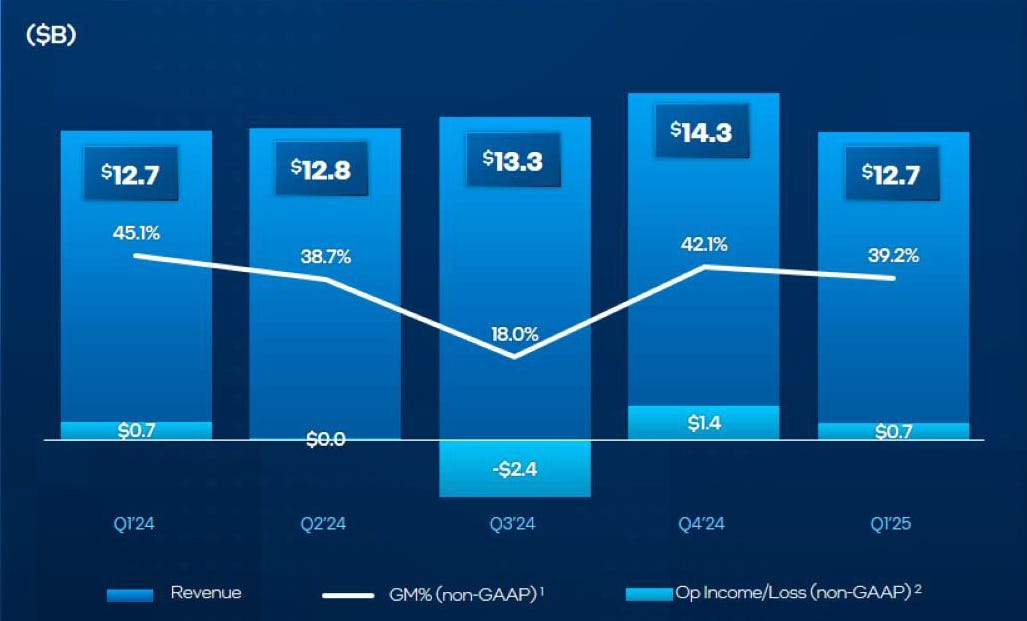

For the first quarter of 2025, Intel’s losses have accelerated on both a quarterly and yearly basis. At $12.7b in revenue for the quarter, Intel’s revenue is effectively flat on a year-over-year basis. But a higher cost of sales (driven in part by the increased use of TSMC on client), investment losses, and higher taxes have all combined to drive Intel further in the red. Consequently, the company reports having lost $887m for the quarter on a GAAP basis.

On a non-GAAP basis, things are slightly better. There, Intel is at least profitable, to a tune of $580m, so Intel’s core businesses aren’t outright underwater. But the company has significant acquisition, restructuring, and compensation that all have a very real cost to the overall business.

Otherwise, the company’s gross margins are down across the board. GAAP gross margins came in at 36.9% for the quarter. Although is far better than Intel’s brutal Q3’2023, it is still below Intel’s average for the past couple of years. As expected, non-GAAP figures do look better, at 39.2% for the quarter, but conversely the year-over-year decline is actually greater for non-GAAP gross margin.

As mentioned previously, the silver lining here for Intel is that they were expecting this quarter to be even worse – so the company has beat its Q1 guidance for revenue and gross margins. $12.7b in revenue comes in at the very top end of Intel’s previous guidance of $12.2b, +/- $500m. Meanwhile both GAAP and non-GAAP gross margins are a bit over 3pp ahead of 33.8%/36.0% projections, helping to avoid an entirely brutal quarter for the chipmaker.

Intel Foundry

💵 Q1 Revenue $4.7b, up 7% YoY

💰 Q1 Operating Loss $2.3b, down from $2.4b loss YoY

📈 Q1 Operating Margin -50%, up from -56% YoY

Please note that Intel Foundry had an event on 29th April. We’re preparing a separate article on the topic, but will include salient points here.

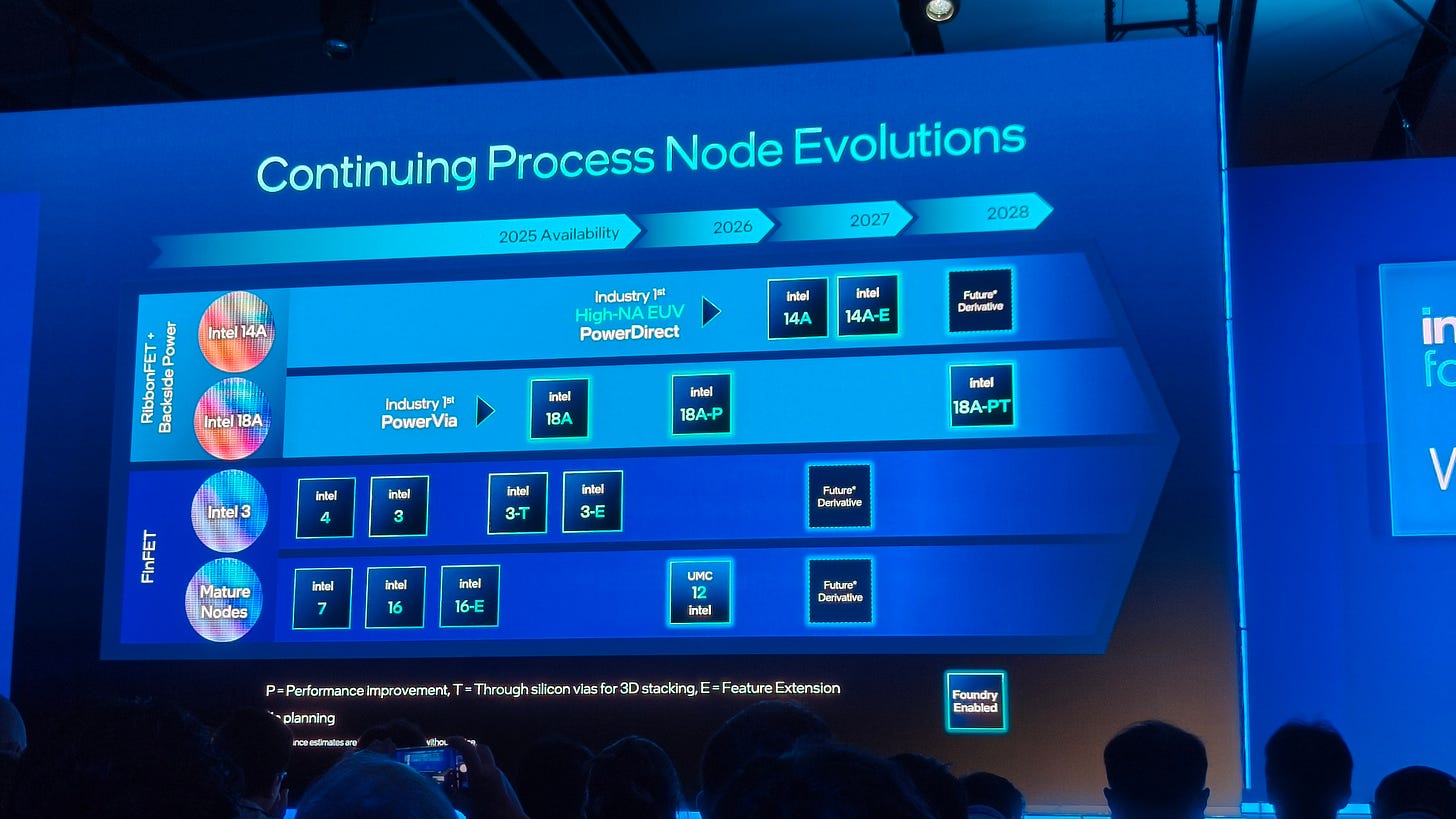

The actual chip-making arm of Intel, Intel Foundry continues to find itself in an uncomfortable spot amidst its own turnaround into becoming a major player in the contract foundry world. Former CEO Pat Gelsinger all but bet the company on Intel Foundry and its ability to develop its 18A process node – which is expected to ramp in the second half of this year for the Panther Lake client launch – and in the meantime the costs of producing Intel’s in-house chips as well as preparing for future nodes continues to make the business unit a painful (but necessary) drag on Intel’s finances.

Unfortunately, very little has changed for Intel Foundry over the preceding quarter – nor will it for a few more quarters, until 18A ramps and Intel can start producing chips for clients (as well as the ramp start of 18A-P). This means that the foundry group is continuing to operate with margins hovering around -50%, though this is a slight improvement over both the year-ago and most recent quarters. Revenue has ticked up slightly to $4.7b, which isn’t particularly moving the needle on operating margins, but at least means Intel is getting more business through its fabs. On which note, Intel also reports that Intel Foundry has seen increased use of its advanced packaging services, which is a combination of its client and server (Xeon 6) processors as well as external engagements.

Curiously, Intel is also reporting that they are now capacity constrained on the Intel 7 process, despite the fact that Intel’s leading-edge chips are moving away from it and Intel wrote down a significant amount of Intel 7 equipment only a couple of quarters prior. And while this only earned the briefest of mentions in Intel’s prepared remarks, the matter came up in the Q&A portion of Intel’s analyst call as well. In short, there’s still significant demand from customers for older chips, such as Meteor Lake, primarily for cost reasons. Intel’s newer chips (Lunar Lake, Arrow Lake) are superior in almost every way, but their need for advanced packaging and use of TSMC is not doing Intel or its customers any favors in regards to costs, whereas Intel’s monolithic chips are relatively straightforward and being built on equipment that has all but been written down.

Though on that note, this did raise the question with analysts of how Intel has ended up being capacity constrained on Intel 7 after writing down so much of the equipment for that node last year. Intel has essentially gone from having more Intel 7 capacity than they could ever need – thus making the associated tools useless – to not having enough capacity for that node only half a year later. Whether that means supply is out of alignment – too much capacity was taken offline – or if it’s a matter of demand, remains unclear.

Intel 7 matters aside, Intel’s long-term goal remains to bring most of its own chip fabbing needs back into the company, but Intel hasn’t given up on its flexible foundry model, either. As a result, Intel Foundry still needs to be able to compete with outside fabs – namely, TSMC. Which means that even following the 18A ramp-up , Intel Foundry isn’t going to have a lock on Intel’s chip fabbing needs. For Intel Foundry to flourish, 18A will need to deliver on all of its performance and manufacturing goals.

It should also be noted that Intel has announced over the last few months that the planned build out of extra facilities in Ohio and Germany will be pushed out by a couple of years apiece – while Intel will complete building the shells for these sites, the tool installations will be delayed until demand from external customers ramps sufficiently to make them cost effective. There is a lot of negativity from investors about this change, however it’s important to understand that Intel always used to have ‘empty shells’ it could expand into – and for the last ten years that was never the case. With Ohio and Germany, Intel now has that option.

Data Center and AI (DCAI)

💵 Q1 Revenue $4.1b, up 8% YoY from $3.8b

💰 Q1 Operating Income $575m, up from $417m YoY

📈 Q1 Operating Margin 13.9%, up from 10.9% YoY

The first of Intel Products’ two top-line chip businesses, DCAI has undergone a minor transformation with the ingestion of Intel’s networking unit, which was previously part of its NEX group. Whether this is a good thing for DCAI as a whole is up for debate: Intel’s adjusted DCAI operating income and operating margins are both up and down versus the old structure, so it’s not clearly an improvement or a regression. If nothing else, the operating margins are flatter, with Q1’25’s results being the first time in a year that the revised DCAI has cracked 10% margins. Otherwise, the business unit reshuffling means that DCAI revenues are up roughly $800m to $1b versus the old structure, somewhat blunting the visibility into Intel’s datacenter CPU and GPU sales.

Overall, DCAI is on a minor upswing for the first quarter of 2025. With $4.1b in revenue for the quarter, revenue is up 8% on a year-over-year basis. And, perhaps more importantly, DCAI’s operating figures have also improved. The $575m in operating income is the most the group has booked in over a year – as far out as Intel’s revised figures go – and the group has also delivered its best operating margin in that time frame, with a margin of 13.9%.

The otherwise sleepy Q1 hasn’t seen the release of any major new products from Intel – though the company has launched some additional Xeon 6 SKUs to fill out the portfolio – so Intel’s situation hasn’t significantly shifted in the last few months. Still, according to the company they saw better than expected CPU sales for use as AI hosts, as well as storage computing. The AI hardware however, still remains a lower-than-expected revenue.

Looking at the long term, DCAI remains Intel’s favored child, with the company looking to it to deliver the kind of explosive growth and higher margins that client computing cannot deliver. Still, those changes are likely still years away, leaving DCAI as the decidedly smaller of Intel’s two chip design business units at this time.

Client Computing Group (CCG)

💵 Q1 Revenue $7.6b, down 8% YoY from $8.3b

💰 Q1 Operating Income $2.4b, down from $2.8b YoY

📈 Q1 Operating Margin 30.9%, down from 34.1% YoY

The current breadwinner amongst Intel’s business units, the Client Computing Group, has absorbed Intel’s edge computing business this quarter, resulting in its historical performance being revised to incorporate the revenue of the former. The net result is that CCG quarterly revenues are around $600m to $800m higher than before, but operating incomes and operating margins are both down. In essence, it seems that CCG has inherited an underperforming product line.

Unfortunately for Intel, Q1 is a historically and seasonally weak quarter for client sales, and 2025 was no exception. With $7.6b in revenue for the quarter, CCG is down on both a quarterly and yearly basis. And, similarly, its operating income of $2.4b and operating margin of 30.9% are below even Q1’24. At nearly four-times the operating income of DCAI, CCG is still by far the stronger business unit, but this is not its finest showing.

Intel’s limited explanation for CCG’s performance for the quarter is essentially that the business unit is performing as expected. The company stopped providing any insight on ASPs some time ago, but citing higher chip volumes, the implication is that ASPs have slipped in the face of competition with AMD. At the same time, Intel’s chip fabbing needs are being met by TSMC more than ever, which comes at a higher cost than building things internally and isn’t doing Intel’s margins any favors. Meanwhile, in a surprising turn of events, Intel reports that demand for Raptor Lake (13th & 14th Gen Core) processors was much stronger than expected, which combined with improved costs for Meteor Lake has helped to improve CCG’s performance.

Intel is technically still in the midst of the Arrow Lake ramp. The bulk of those processors – including the all-important mobile chips – were just launched at the start of Q1. And while Intel starts delivery a quarter before, it typically takes a couple of quarters to ramp. So we have yet to see the full impact of Arrow Lake on CCG’s performance.

All Other (Altera, Mobileye, IMS)

💵 Q1 Revenue $943m, up 47% YoY from $643m

💰 Q1 Operating Income $103m, up from -$170m YoY

📈 Q1 Operating Margin 10.9%, up from -26.4% YoY

Intel’s final, catch-all business unit, “All Other,” which houses Mobileye (88% ownership), Altera (100% to 49%), IMS Nanofabrication (68%), and others, remains essentially unchanged from the end of Q4. The pending sale of Altera to Silver Lake, where Intel will still own 49%, is expected to close in the second half of 2025.

Intel’s color commentary continues to be quite minimal for this business unit, in part because many of its sub-units aren’t under Intel’s full control. Nonetheless, All Other gets the privilege of reporting the best year-over-year improvement of all of Intel’s businesses, swinging from a -26.4% operating margin to a positive 10.9% on a YoY basis. Accompanying this is a jump in revenue from $643m to $943m.

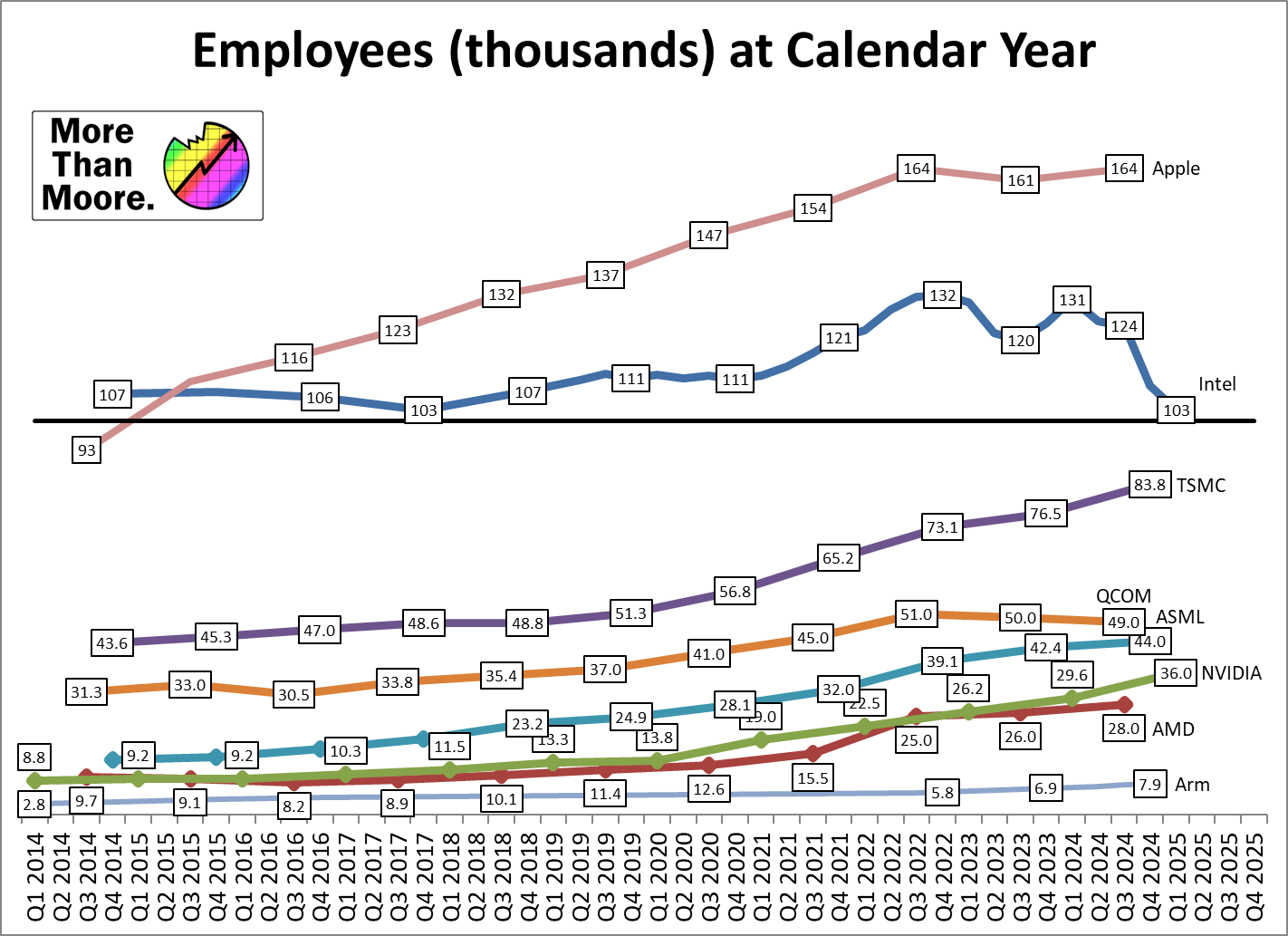

Employee Counts

Last year, Intel announced a headcount reduction of around 15000 people from a total of 124100.

Tracking the numbers, Intel now sits at 102,600 – but that includes a 4,000 drop attributed to the final part of the storage sale to SK hynix.

Outlook, Q2 2025

💵 Q2’25 Revenue, $11.8b, +/- $600m

📈 Q2’25 Gross Margins of 34.3% (GAAP) and 36.5% (non-GAAP)

Looking forward to the rest of Q2’25, the US is currently undergoing what CFO Dave Zinsner has charitably labeled “fluid trade policies,” and as a result Intel is taking a more conservative stance with its financial projections.

Citing the growing probability of a recession – and thus a shrinking TAM for computing products – Intel is projecting between $11.2b and $12.4b in revenue for Q2. This would be an unusual (but not unprecedented) drop in revenue coming from what is seasonally Intel’s weakest quarter into what is often a more active quarter – though Intel is quick to note that Q2 for them is historically flat. Ultimately, this has resulted in Intel projecting a slight decline in sales, with DCAI revenue expected to drop off more significantly than CCG. Otherwise, Intel’s wider-than-usual revenue window reflects this uncertainty, as while Intel is reasonably confident of a drop, they aren’t very certain about how big it will be since so much of what might happen is out of their hands.

Unfortunately, this also means that Intel’s battered gross margins are going to take another hit going into Q2. With a projected non-GAAP margin of 36.5%, 2.2pp below Q1’24, Intel is looking at going even farther into the red for Q2.

Looking at Intel’s product plans for the next quarter, there’s also little change expected with Intel’s product lineups. Intel is now solidly in the middle of their product cycles for all of their major product lines – Lunar Lake, Arrow Lake, Battlemage, and Granite Rapids are all shipping and continuing to ramp up in volume through the first half of this year. So while Intel’s chip mix continues to shift to newer products, there won’t be any major shake-ups for Q2 (at least among shipping products).

Intel’s next big development milestone remains the 18A process node and its associated GAAFET and Backside Power Delivery (BSPDN) technologies. As of today, 18A remains on track to ramp for high volume manufacturing in the second half of this year, in time to supply tiles for the launch of Intel’s Panther Lake client part at the end of this year, and then a fuller launch into 2026 of more Panther Lake and next generation Clearwater Forest Xeon processors.

Otherwise, the biggest developments for Intel in Q2 of 2025 and beyond are going to be the changes ordered by Lip-Bu Tan, as he begins to implement his vision of what Intel should be. As previously noted, Tan is looking to slim down Intel’s operations, particularly its management, and a new round of job cuts are expected. While there are rumors going around to the size of these cuts, for now Intel remains undecided (or at least unwilling to disclose) just what those cuts will entail. The report from Bloomberg citing 20k was never verified by a second source, and the first unnamed source remains unnamed. It has been announced, however, that Chief Commercial Officer Christoph Schell will be leaving the company in June. Schell joined in 2022 under the previous CEO, with some internally remarking that his tenure felt more like a cruise than a course correction.

More immediate, perhaps, will be Tan’s cuts to Intel’s spending. With the company already operating in the red, Tan has made it clear he isn’t shying away from cutting Intel’s spending – though not recklessly so. At the Intel Foundry Direct Connect event, Intel confirmed that CapEx spent over the last four years totaled $90 billion. The big news here is that Intel will be cutting its gross capital expenditures for 2025 from $20b to $18b. And Tan has promised to take a closer look at Intel’s existing fab capacity to make sure it’s being efficiently utilized before committing to any additional spending. All of which is to say that it looks like a slowdown in fab expansions and upgrades is in the cards.

The new CEO and his team are also looking to trim operating expenses as well as part of their broader push for greater efficiency. For 2025 that’s looking to be a $500m cut, bringing non-GAAP operating expenses down to $17b. Meanwhile for 2026 the target is to shave off another $1b, bringing down expenses to $16b. These figures don’t include restructuring charges that would stem from layoffs, so Intel expects to incorporate those in the future once they have decided on potential layoffs.

Overall, while Tan is not radically changing Intel from the get-go, the new CEO is clearly looking to make a mark on Intel both in its culture and in its operations. So the long-term outlook for Intel is something of a mixed bag, with Intel preparing for short-term pain in order to reap long-term gains and to once again grow the company. Only time will tell how this goes.